Introduction & Executive Summary

This year we have seen two very interesting dynamics impact home services. First, as COVID-19 became a global pandemic, people began spending more time at home and taking on more home projects as both the intrinsic and fiscal value of homes rose.

Second, after months of stress and isolation, the American workforce is seeing unprecedented change and movement as workers across the country change jobs and careers. After prolonged work impacts due to the pandemic, we are amid what has been come to be known as “The Great Resignation.” This moment is marked by high disengagement, frequent resignations, more job openings than workers looking for work, and worker empowerment.

Demographic tailwinds, cultural shifts, a once in a century global pandemic, an unprecedented shift in how people live and work, a drop-in mortgage interest rates and corresponding gain in home equity, a rise in household wealth, and widespread new technology adoption, as well as a persistent shortage of skilled labor, are all combining to create the most dynamic, challenging and opportunity-filled moments in the modern history of the trades.

At a time when there is both booming consumer demand for home improvement, construction and maintenance work, as well as growing concern over worker disengagement, the skilled trades have a huge opportunity.

The trades represent careers with high job satisfaction driven by a connection to the meaning of the work, high pay, and high levels of entrepreneurship. The attributes that are being sought – hard work and a good attitude – harken back to a focus on work ethic, grit, determination and the joy of completing a job well done. If home trades recognize the connection between what their trades offer and what workers are seeking during the Great Resignation, we could begin to see a narrative change around trade labor and start to reverse the labor shortages that have impacted the trades for years.

In addition to impacting labor and workers in the U.S., the COVID-19 pandemic fundamentally changed the way people view their homes. As the world shut down in early 2020, people took refuge in their homes. Even as the country reopened, people continued spending more time at home and the role of the home has changed. The home is more important than ever and consumer demand for work on our homes has flourished.

In this second annual version of our report on the skilled trades, we provide a year-over-year look at not only how the industry is earning, aging and recruiting, but also at how job satisfaction is holding up, how COVID-19 has impacted business practices and technology adoption, and how individual business owners and tradespeople can strategically navigate the market.

Topline:

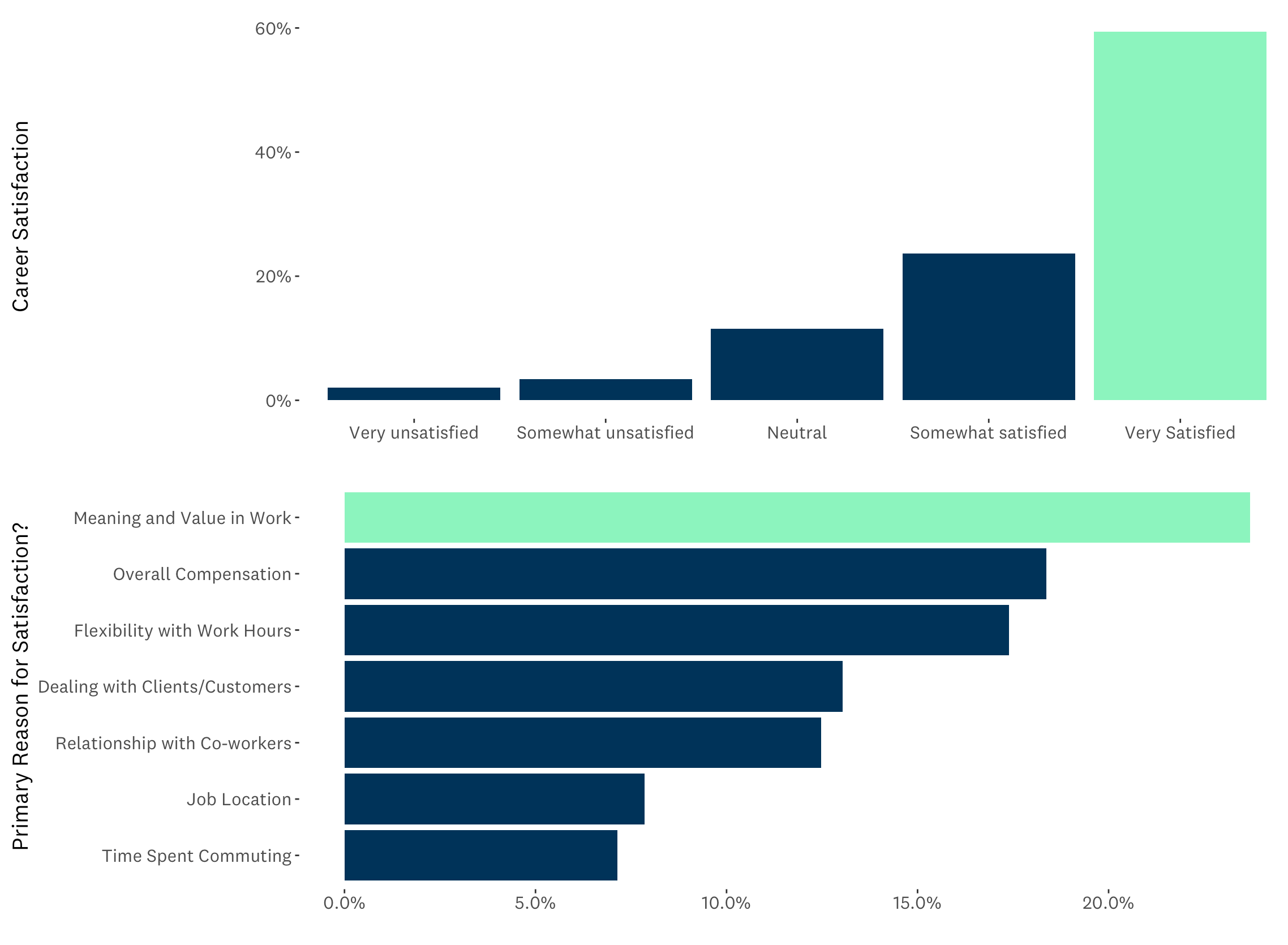

- Job satisfaction remains remarkably high, with 83% of tradespeople either somewhat or extremely satisfied in their choice of work

- The materials shortage impacted more than 8 of 10 tradespeople, with shortages experienced in lumber, flooring, roofing and other fixtures

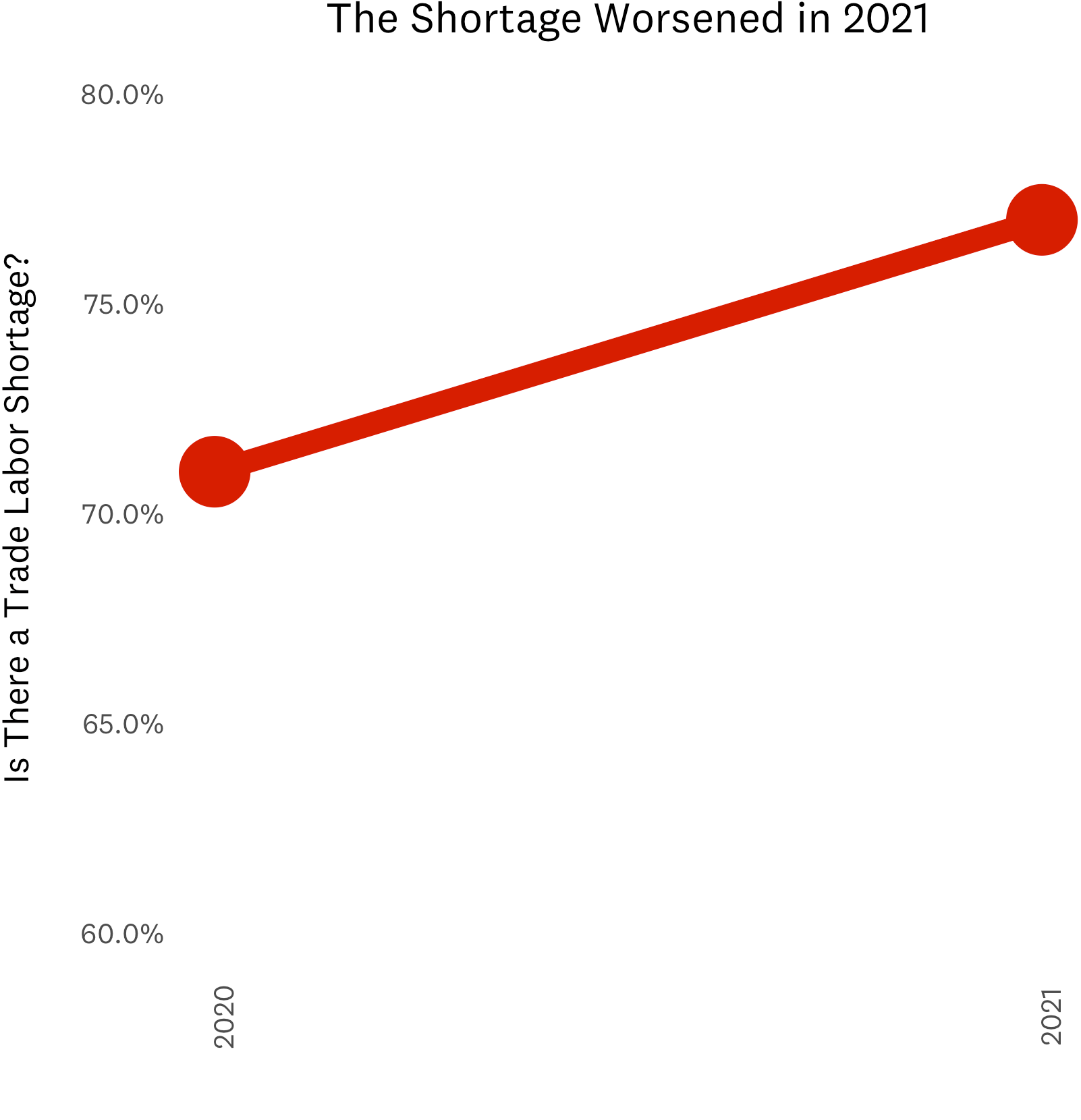

- The labor shortage is worsening, with 77% of tradespeople viewing it as a problem compared to 71% a year ago

- 74% of tradespeople shift their mix of work between existing residential construction and other forms of work such as commercial buildings and new construction, with 60% citing changing market demand as the primary reason for shifting work mix

- The skilled trades are aging, with a median age of 43, roughly 10% older than the general population

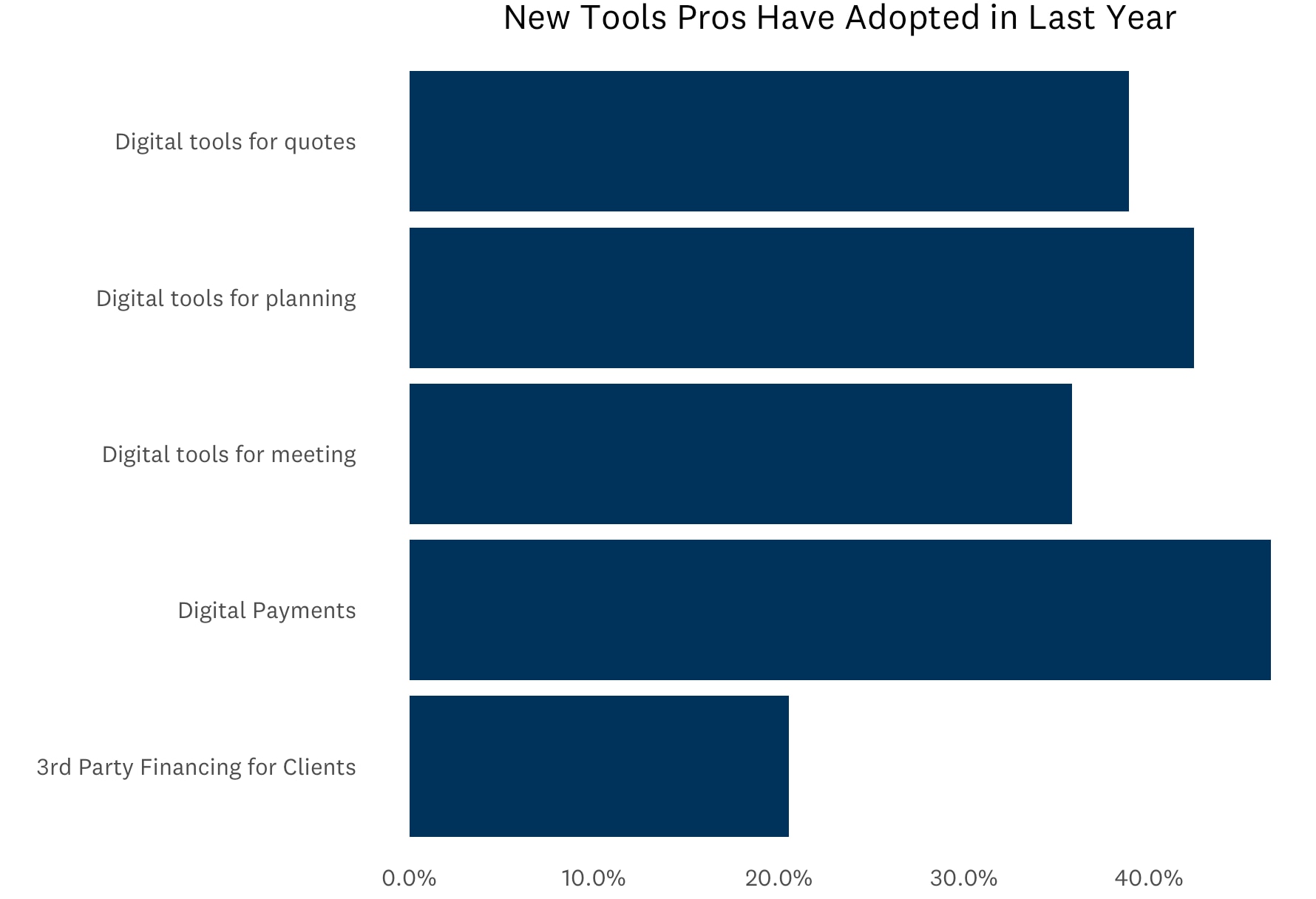

- Nearly half of all pros adopted some form of expanded digital payment in the last year

2021 represents one of the most interesting and dynamic periods in the trades and marks a particular inflection point where demographics, market trends and a global pandemic unprecedented in the modern era have conspired to produce unparalleled demand for work in the trades.

The adage that ‘opportunity is missed by most people because it is dressed in overalls and looks like work’ has never been truer than it is in 2021.

Mischa Fisher

Chief Economist, Angi

Part 1: The Fusion of Craftsmanship with Entrepreneurship

At Angi, we often think about home service professionals only in the context of working on the over 140 million existing homes in America. But it is important to remember there is considerable variation in what an individual tradesperson works on; between existing homes, new builds, and commercial construction, the home services trades really encompass all tradespeople.

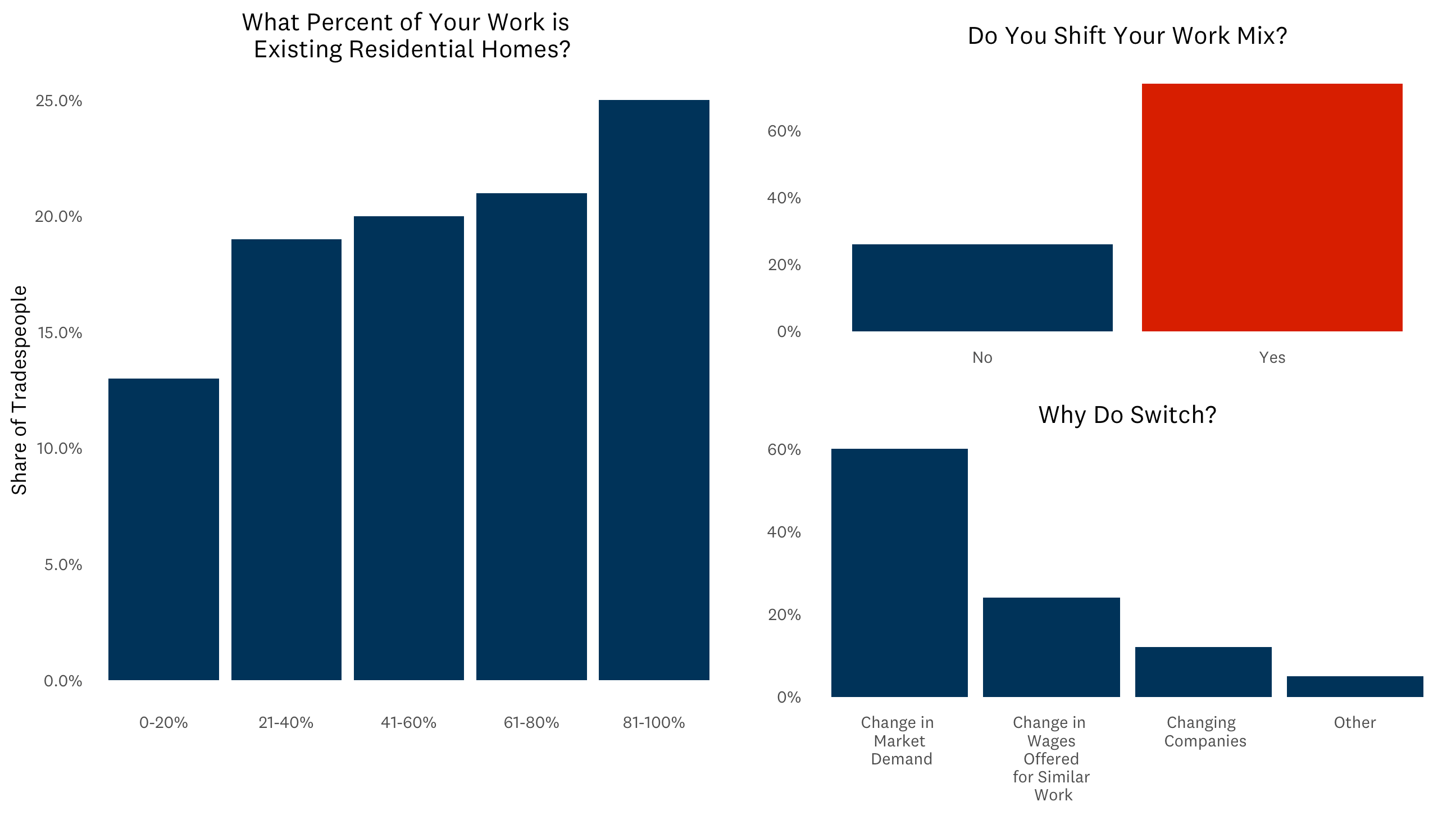

This year, we asked tradespeople about how much time they spend working on existing homes, new homes, and commercial construction. We found that work is spaced out and more fluid than expected, with some skilled tradespeople spending less than 10% of their work on existing residential homes to some spending 90-100% of their time on existing residential homes. However, the distribution of time spent on homes across all tradespeople is relatively uniform, with roughly 60% of tradespeople spending at least half of their time working on existing homes.

More importantly, this is not static: more than 75% of skilled tradespeople shift their mix of residential homes year-to-year. Why? 60% cite changing demand, 24% cite changes in wages offered for similar work, and 12% cite changing companies as their primary reasons for adjusting their mix of work.

This is highly entrepreneurial thinking and action.

With so much of our physically constructed world being a function of this wide range of work, and knowing that earnings and wages are principal motivators, we first explore the earning and wage rates of the skilled trades, before looking at demographics and job satisfaction.

Earning and Wages in the Skilled Trades

Skilled tradespeople constantly shift their mix of work. 60% of pros cite change in market demand, which indirectly leads changes in wages. Higher and lower demand result in higher or lower wages. With increasing demand across commercial construction, new residential home construction and work on existing homes in recent years, it is no surprise to see high wages paid among the trades in part because of this tendency to shift the mix of where they are working.

Looking at a topline analysis comparing a few well-known trades – plumbers, electricians, general contractors – average annual earnings are 22%, 29%, and 53% higher than that of the general population. This means that for a sizable portion of the labor market, switching to a career in the skilled trades could mean a considerable pay bump.

While average income is an important metric, so is income growth. When surveying skilled tradespeople, we specifically looked at how earnings grow as careers progress from entry level to experienced. Home tradespeople nearly double their income from junior to experienced, with wages nearly doubling as well, rising roughly 80% depending on the different skillsets.

Demand for the work, income levels, and wage growth potential mean that in most of the country, a majority of people could earn more by considering a career in the trades.

While current statistics on earnings are important, it is also essential to get perspective on the industry, starting with the ages of people in these trades.

Entering, Aging, Retiring

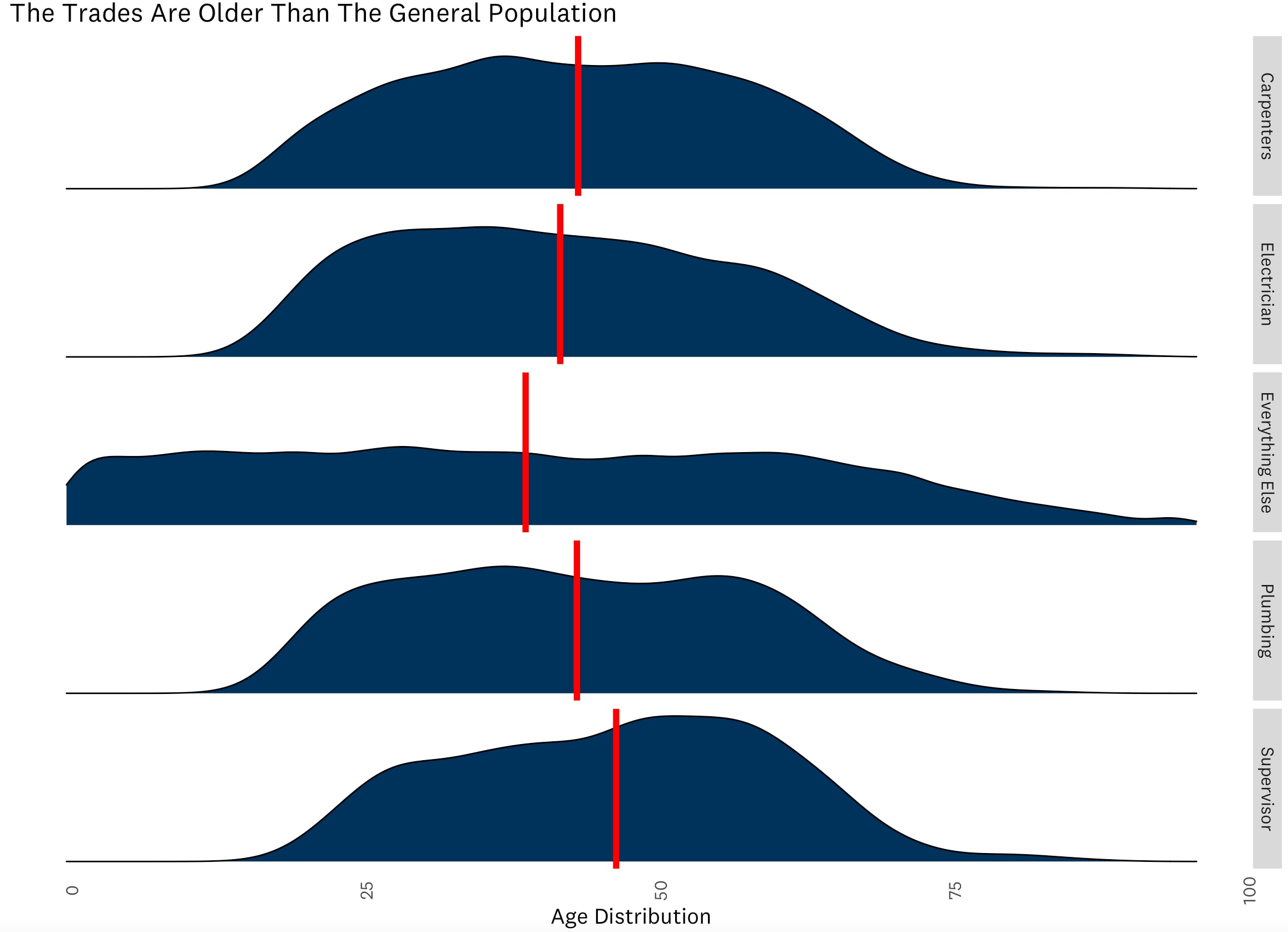

Skilled home tradespeople are aging. The average age of both electricians and plumbers is 43 years old, 11% older than the general population. For first line supervisors of the construction trades, which could include occupations like general contractors and handymen, the median age is 47. That’s 24% higher than the overall average age of the population.

More than a quarter of home tradespeople, 27%, are within 10 years of the social security retirement age of 62.

The aging of home tradespeople is not a surprise to people close to home service trades or even to homeowners who often hire trades for work in and around their homes. For this report, when we surveyed pros about age, they entered the trades and age pros are now entering the trades, there is a decided shift seen.

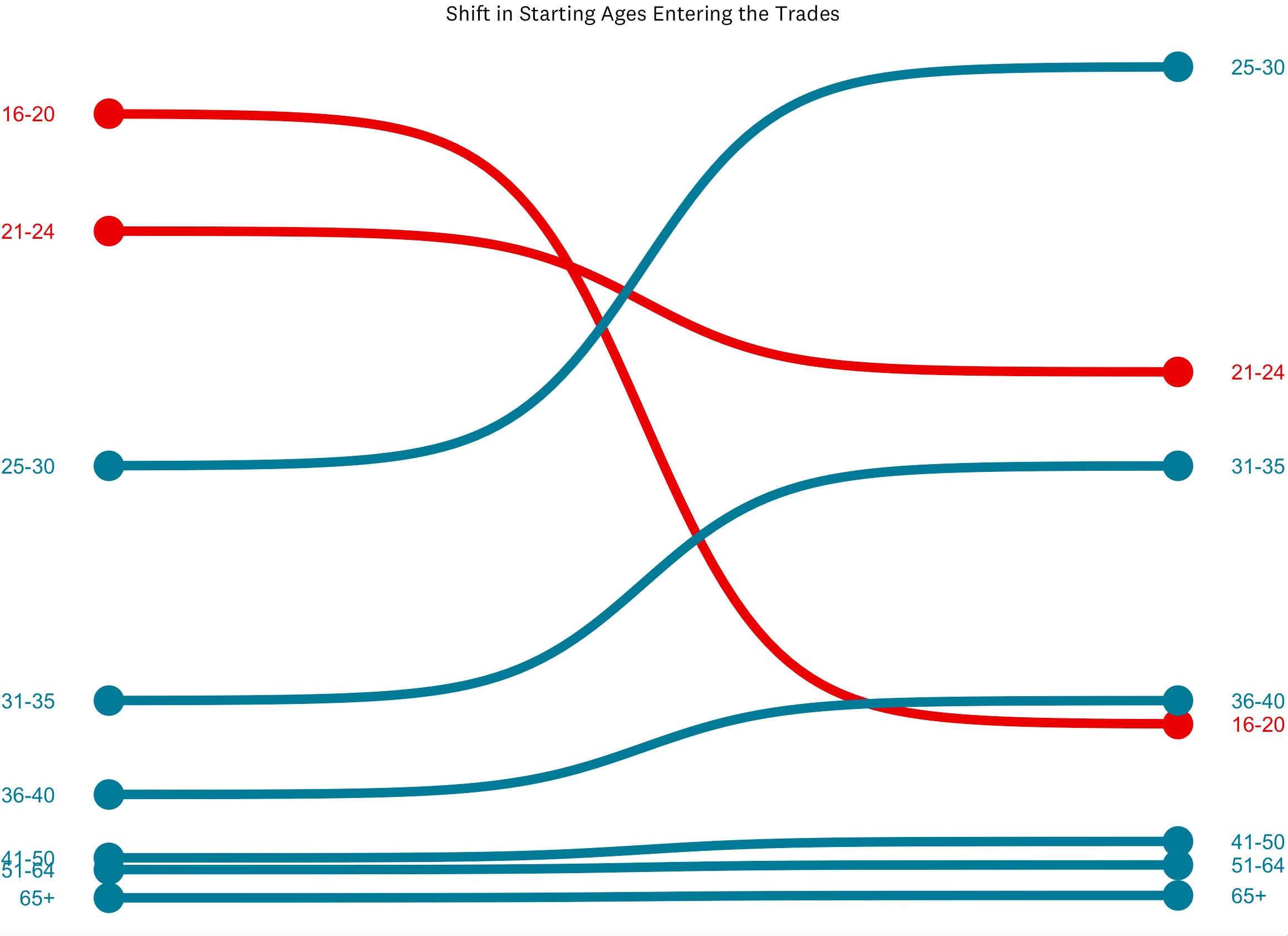

Of tradespeople surveyed, 33% said they joined the trades between 16 and 20, and only 18% joined between 25 and 30. In direct contrast, this ratio is flipped for the observed ages of people entering today: 35% of people said 25-30 is the primary age when they see people entering the trades, and only 7% said they see 16- to 20-year-olds joining.

Why are people not joining the trades between ages 16 and 20? What could be the reason for delayed participation in the industry?

College. Since 1980, college enrollment has increased over 60%. In those same years, the costs of both two- and four-year collegiate programs have risen over 300%, controlling for inflation.1 With more people choosing to enroll in college right out of high school and the cost of college rising, millions are taking on student loans.

With student loan debt standing at 1.6 trillion2 and a shortage of opportunities for graduates in many fields, the changing age of people entering the trades is not a surprising trend, since many people could be entering the trades after finding a disappointing labor market in other areas of the economy.

The trades not only have a wide range of work options, higher than average salaries, and the opportunity for promotion and wage growth as older workers retire, but they also have a particularly compelling value proposition: tremendously high job satisfaction.

Job Satisfaction and Finding Meaning and Value in Work

Job satisfaction in the skilled trades is exceptionally high.

Nearly 9 out of 10 (83%) tradespeople list their job satisfaction as either very satisfied or somewhat satisfied, with fewer than 1 in 20 people saying they’re somewhat or very unsatisfied in their current line of work. This is a slight improvement from last year last year when 82% of people were either somewhat or very satisfied in their choice.

While compensation increased as the primary reason for job satisfaction, across 2020 and 2021, meaning and value in the work was still the key factor impacting overall satisfaction, with 22% of all tradespeople and 24% of the extremely satisfied citing it as the primary driver of their happiness.

This is both descriptively useful for understanding the trends in a broad sense, but also actionable advice for the industry: it is descriptively useful because it allows us to better know the strengths of the trades, and actionable because it should be a key component of the cultural shift that’s required to attract more people to the industry.

Entrepreneurship During the Great Resignation

The skilled trades are a mobile group with the ability to apply entrepreneurial thinking, follow demand across many categories, earn above average wages and grow wages and income as skills build. Tradespeople are also very happy and feel connected to their work and the meaning of their work.

It is time to change the narrative now and challenge the perception of the trades while people are disengaged from their current occupations in other industries. We need to do this before it is too late.

The reality is a large portion of tradespeople are approaching retirement and those who are entering the trades to replace them are doing so later in life than previous generations, and so will themselves have shorter careers than previous generations.

Part 2: The Labor Shortage & Recruiting Shortfalls

So how is the industry grappling with an unprecedented global pandemic, dramatic market crash, booming housing recovery, and demographic tailwinds that are driving across the board industry change?

Answer: It is a story of opportunities seized and opportunities missed. On the one hand, the trades have responded to surging demand by navigating supply shortages and filling their pipelines with projects. In other words, they saw the surge in demand as an opportunity and rose to it.

However, there is a shortage of labor. It is real, it has worsened and recruiting is missing the mark. With diversified sources of work, above average incomes, high job satisfaction, finding meaning and value in the work, and vacancies slated to open as a result of an aging workforce, skilled home trades should be able to recruit more effectively than they are now. We will explore some of the reasons for the labor shortage, why it is worsening and what the trades could do to improve recruitment.

2.1 The Labor Shortage is Real and Worsening

Only 12% of tradespeople do not think there is a shortage in the skilled trades, with 10% unsure. In other words, a vast majority of trades people (77%) believe there is a shortage in the skilled trades and that number has grown over the last year. In 2020, 71% percent of skilled tradespeople believed there is a labor shortage, so the share believing there is a problem rose roughly 10%.

We also looked at whether the problem was getting worse, staying the same or improving from the perspective of tradespeople. In 2020, 71% of people said the problem has gotten worse over the last 5 years, in 2021 that grew slightly to 75%. Only 9% percent of skilled tradespeople thought the labor shortage problem has improved.

What this means is there is a strong consensus across the industry; that despite the strengths and opportunities offered, the prospect of an aging workforce, and above average wages and job satisfaction, people are not available to do the work and are not choosing to opt into careers in the trades.

Yet, there is room for optimism. Looking ahead, pros are optimistic about the situation. 55% of pros think it will improve or stay the same over the next five years, only 45% think it will continue to worsen. So, despite 75% of pros recognizing a skilled labor shortage now and recognize it has gotten worse of the last five years, pros remain hopeful when thinking about the future. This optimism could be fueled by a number of things, including the connection pros feel to their work and its value and pros’ deep understanding of the market demand for their work and skills.

So, while it is true on a macro level that the perception of the shortage has worsened over the last year, what does it mean on a more localized level? How is this playing out for individual tradespeople and their businesses?

2.2 How the Labor Shortage Impacts Pros

Skilled tradespeople feel the impact of the labor shortage both in their personal lives and in their professions. When asked how the labor shortage is impacting them and their business, they note four predominant impacts: slowing growth (30.2%), less time for family and time off (30.1%), turning down jobs (29.7%), and decreasing revenue (26.7%).

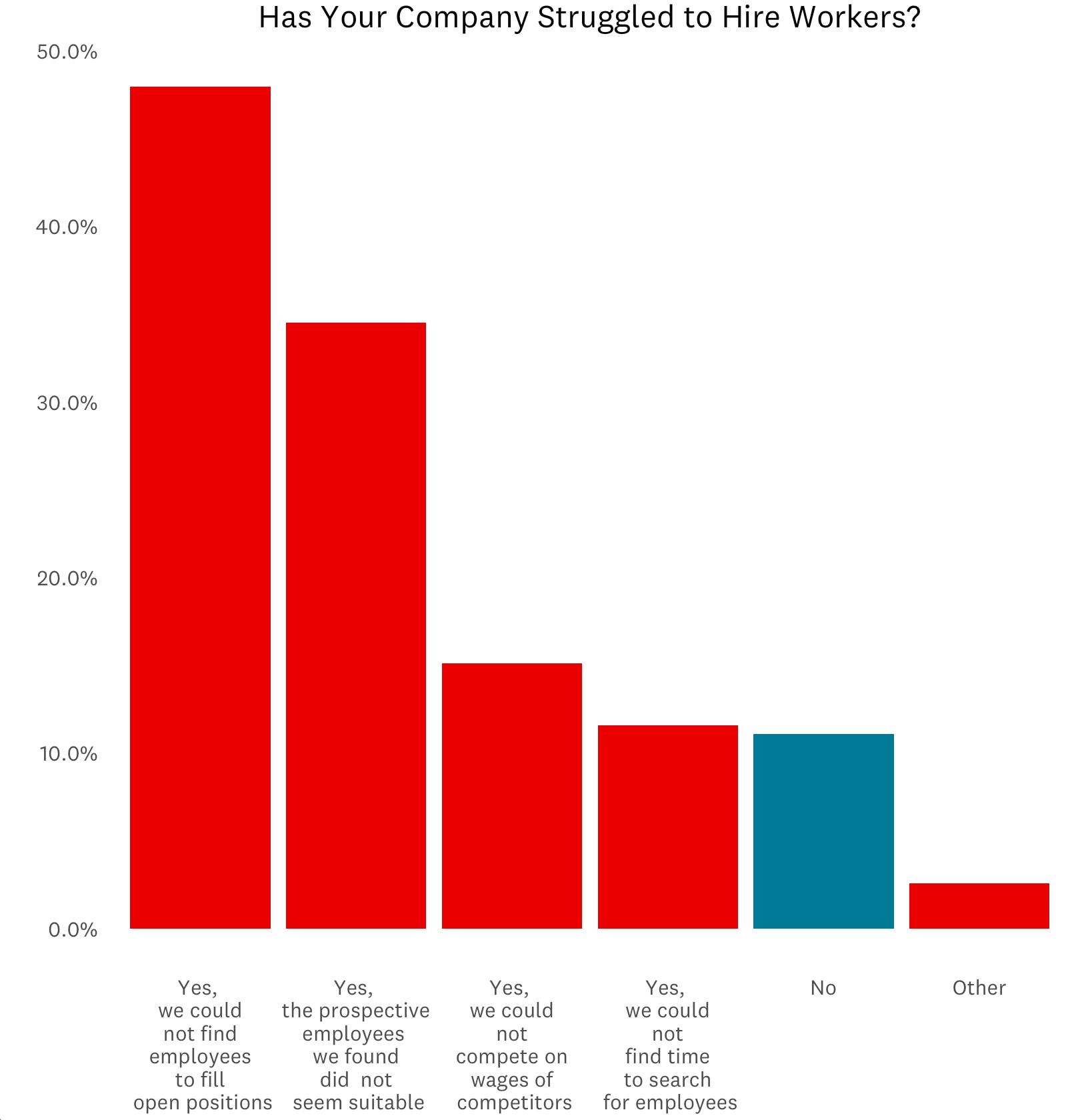

This in turn is resulting in 68% of companies have struggled to hire skilled workers, with half of them (33%) saying they could not find employees to fill open positions.

Of the one-third of businesses that are either somewhat or extremely understaffed (35%), nearly half (48%) said they could not find employees to fill open positions, and 35% said the people they did find did not seem suitable.

These challenges are seen in the 52% of tradespeople who say a lack of available workforce is stunting their growth and the 68% who say that they could grow their business if they could find more available workers

What the combination of all factors implies is that the training pipeline for skilled tradespeople is falling short of the pipeline required to meet demand in the field. While some businesses do manage to reach adequate staffing levels, at least one-third are still understaffed, which is resulting in unmet demand, not enough time off, and lost revenue.

Contextually, there is a lot of movement in the labor markets across the economy, with high rates of turnover, resignations and unmet demand in every sector, every job type and every level. High levels of disengagement are a top reason people are looking to quit their current job and seek a new opportunity. During all of this, pros in the skilled trades are engaged and loving their work, and an opportunity is presenting itself for people to start working on and around the home.

2.3 What Do Pros Think About Solutions?

Beyond just quantitatively measuring the problem, how do tradespeople think about solutions to the problem and its cultural context?

A slim majority (59%) agree that providing a clear pathway for women would make the trades more welcoming, a modest improvement from 2020, when 51% thought it would make a difference. A similar 54% think Americans overprioritize university at the expense of trade school and 62% think there is a lack of respect for blue collar work.

Skilled tradespeople are aligned on the problems that remain a challenge, such as negative perception and the stigma on trade schools. However, there are areas where the common wisdom likely falls short and there are major solutions to explore.

2.4 An Unrepresentative Shortage is a Missed Opportunity

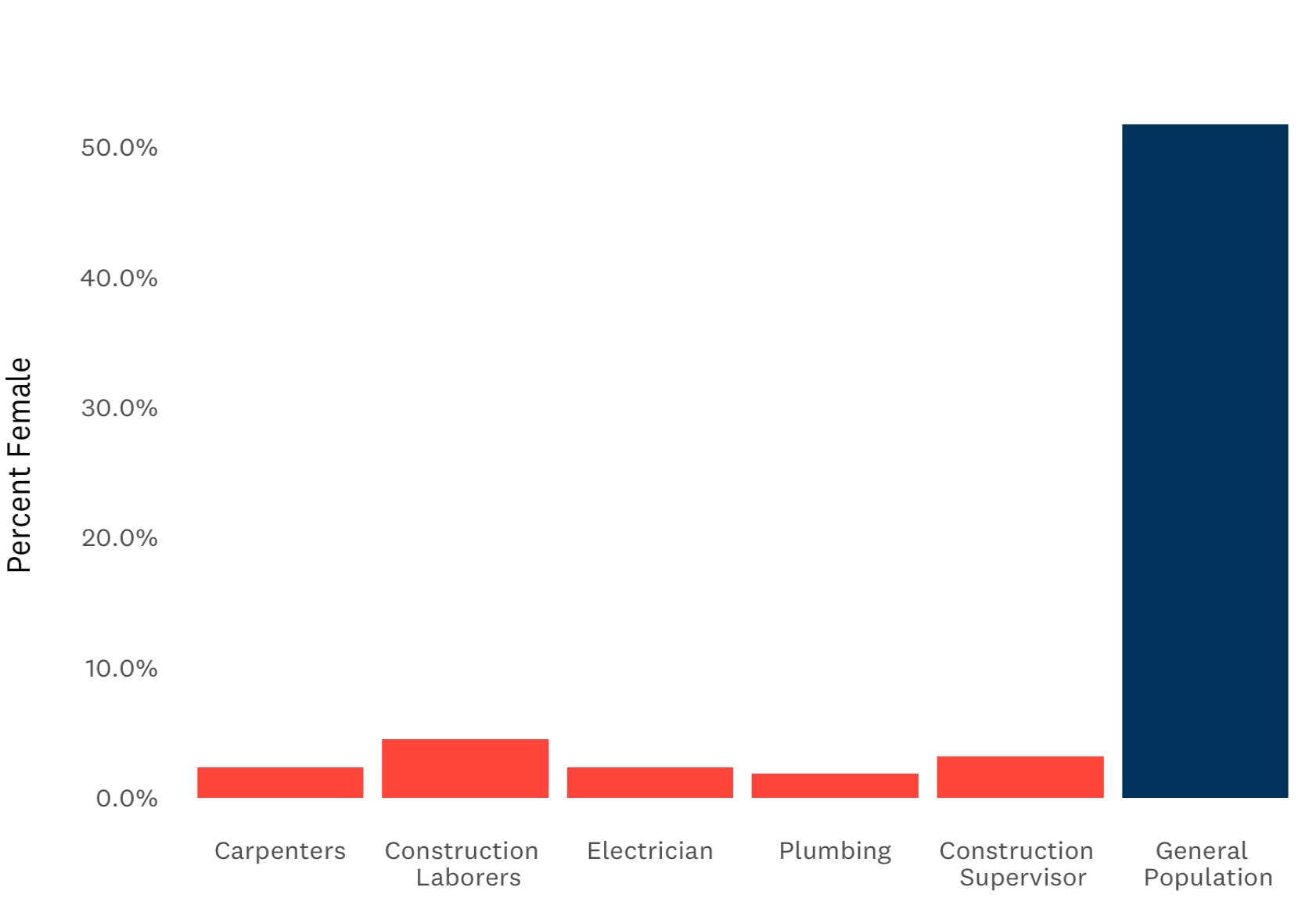

The skilled trades are overwhelmingly male. Electricians and plumbers are 98% male and construction supervisors are 97% male. The construction industry, which encompasses a range of occupations beyond just the skilled trades, is 89 percent male.

Given this disproportionate gender balance, there is a visible disconnect when only a slim majority of tradespeople think providing a clearer pathway for women would help alleviate the trades shortage. With the extremely low percent of women in the trades, the lack of consensus about more intentional recruitment for women seems to understate how much of a lever better recruitment of women could be.

Recruiting more women is a viable pathway to improving things not just because they are so underrepresented, but because we know that women in the industry are flourishing, with similarly high job satisfaction (77%) and in many areas the same or greater relative wage gains.

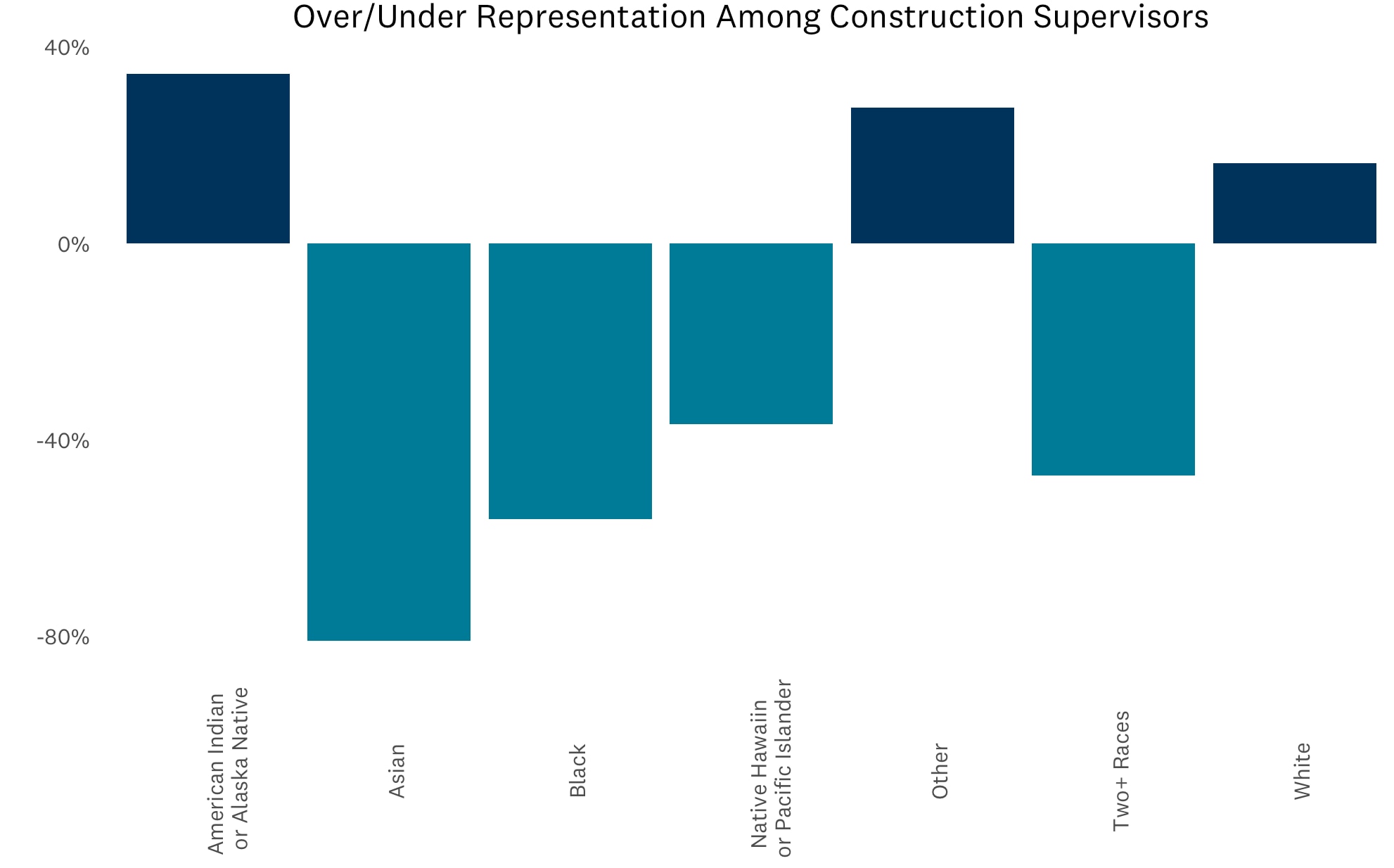

A similar issue is true with other demographic groups, where representation also falls well short of what is demographically possible. The BIPOC share of the total U.S. population is approximately 18%, while only 9% of plumbers, 10% of electricians, and 8% of construction supervisors / general contractors are BIPOC. This means the share is 44%, 46%, and 56% lower than what one would expect from demographics share alone.

This shortfall in representation is particularly poignant when looking at key attributes being sought by those hiring tradespeople.

Key attributes for potential candidates focus on character attitude and capacity for hard work rather than recommendations, four-year degrees or advanced degrees and fluency in English. While only 33% of tradespeople say they care about a recommendation from someone they know as very important, they care a lot about a positive attitude. In fact, 78% list a positive attitude as very important, slightly leading ‘a desire to learn’ which sits at 77%, as the top two most important attributes when hiring. The high priority placed on these attributes mean the industry should expand how far it looks to attract new people to enter it.

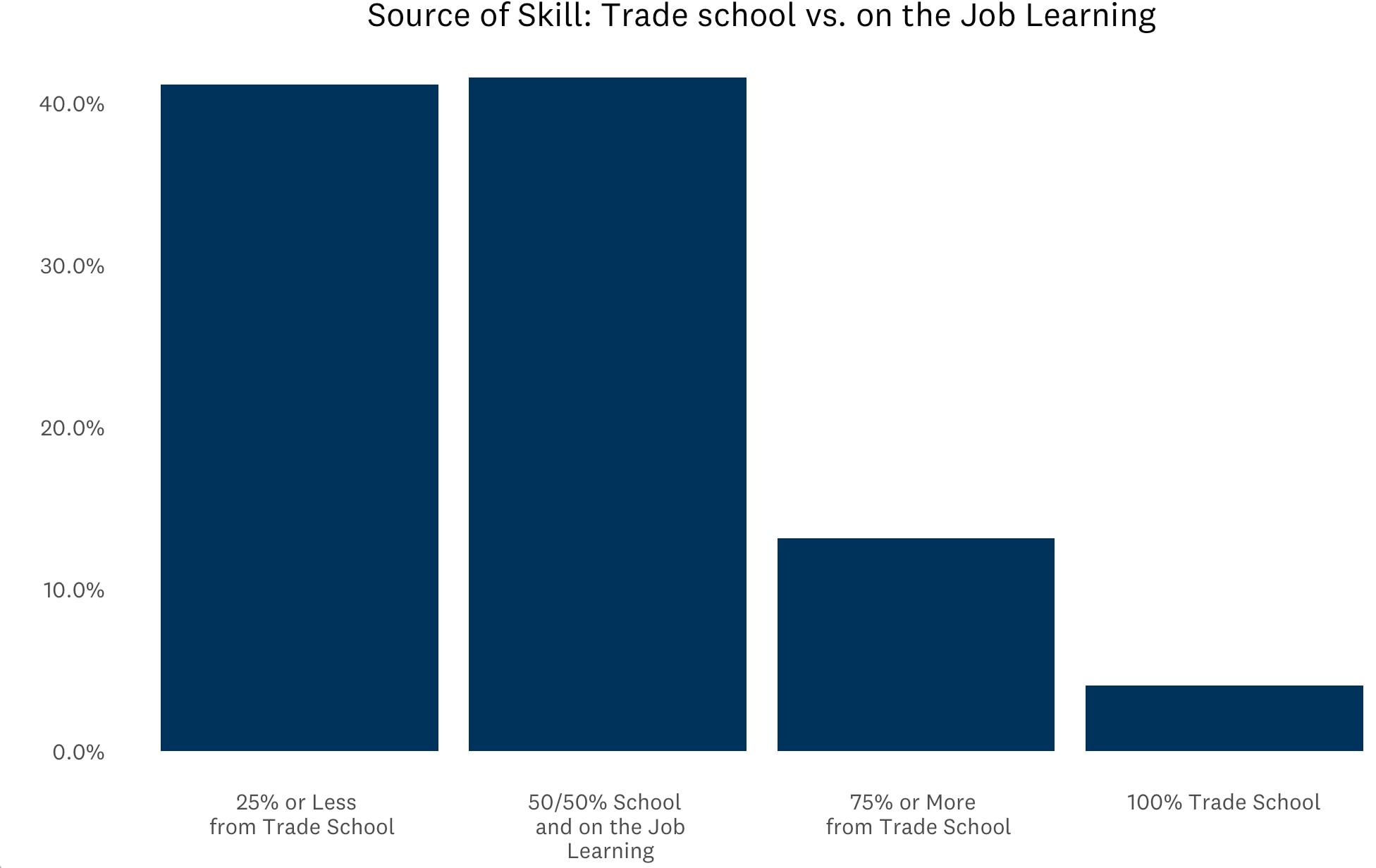

Putting these attributes in context, their value makes perfect sense, since only 3% of tradespeople say they learned all their technical expertise in school. This remarkably low figure is because 42% say they learned most of their technical expertise on the job and 41% say they learned at least 50% of their technical skills outside of trade school. This provides a clear picture of why the attributes prioritized include a desire to learn and a positive attitude so much more than credentials, connections or socioeconomic status.

2.5 Recruiting is Missing the Mark

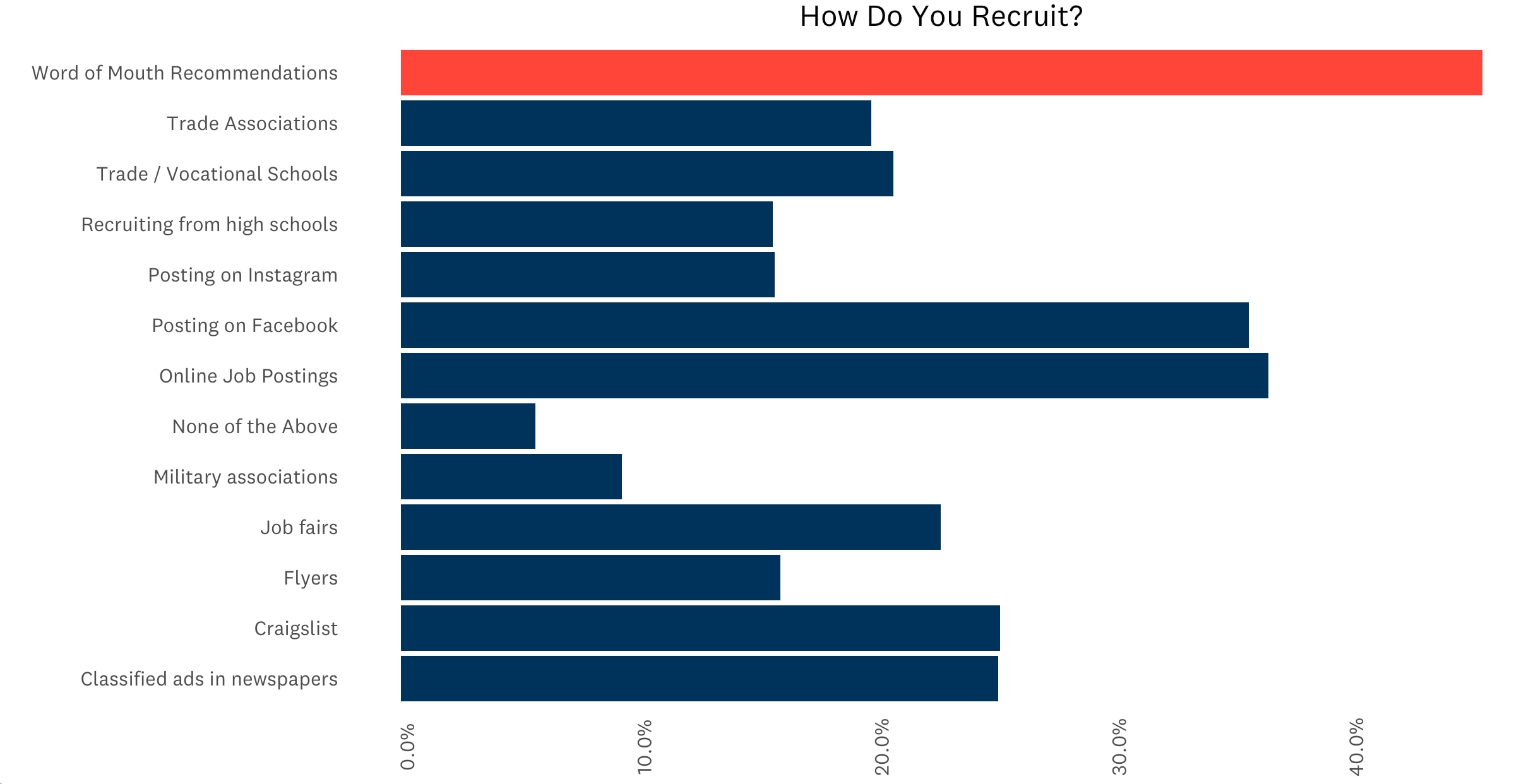

Word-of-mouth recommendations continue to have an outsized presence as the preferred method of recruiting into the trades. Given the demographic shortages and the age of current tradespeople, this strategy is not particularly moving the needle in terms of developing a broader pipeline into the trades over time.

For example, half of pros are evenly split between saying they have seen more or fewer women entering the trades over the past five years, with the other half saying there has been no change. This static picture is exactly what one would expect from an industry that relies on word-of-mouth recommendations within a single gender.

By comparison, more than 80% of Americans use online job searches3 to find employment, and more than 99% of the Fortune 500 companies use some sort of applicant tracking software to increase the efficiency and effectiveness of their recruitment and onboarding.4

Positively, the share using online job postings has risen to 37% from 28% a year ago, but that is still only one-third of all tradespeople and it needs to be higher.

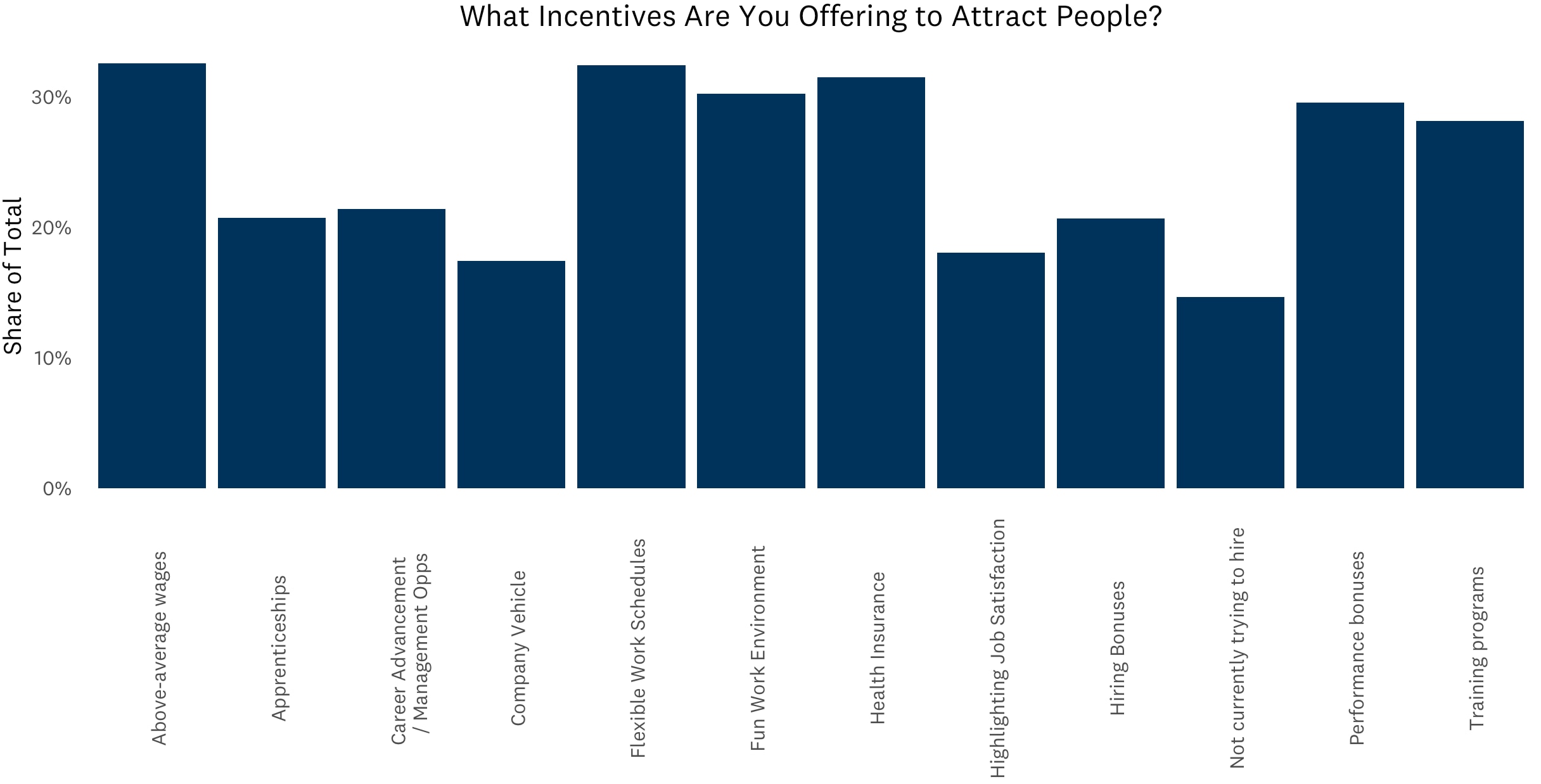

Trades have an opportunity to utilize more modern and engaging recruitment tools, like online job postings. But what about incentives offered as part of the recruitment process? 39% are offering flexible work schedules and a fun work environment, 35% are offering above average wages as a core incentive (consistent with what we saw earlier in this report regarding relative pay in the trades), and 33% are offering performance bonuses.

The major disconnect, however, is reflected by the incongruity behind what drives job satisfaction – meaning and value in work – and highlighting that as a benefit. Only 18% of pros highlight job satisfaction as part of their recruitment offering, making it the second least provided incentive.

A final shortcoming in recruitment efforts, following a similar disconnect, is the high percentage of pros saying that adding shop class back to schools would make a difference in improving the problem (59%) and those who say they are actually engaging with their local schoolboards to support these things (27%). In fact, 40% of tradespeople have not engaged in any form of political or policy-based advocacy for the trades. Given the country’s long history of civic engagement, the trades should take a more active role in the policies that shape the industry.

Part 3: Adapting to Work in a Time of Pandemic

As COVID-19 became a global pandemic, people around the U.S. began to spend more time at home. And with more time at home, the home became the focus. Not only did time shift to the home but also spending. This boom in consumer demand for work in existing homes in 2020 was followed by a boom in buying and selling in 2021.

All the demand for work on existing homes, and the home services activity created by a nationwide boom in buying and selling, caused a crunch in the supply chains, drove up demand for skilled labor, made hiring harder and sped up technology adoption by pros looking to be both safer and more efficient.

These dynamics, while present in other times, were kicked into overdrive during the pandemic. For skilled tradespeople, adapting was not only a necessity, but also, for those who could adapt early, a big opportunity.

3.1 Shortages – Materials and Labor

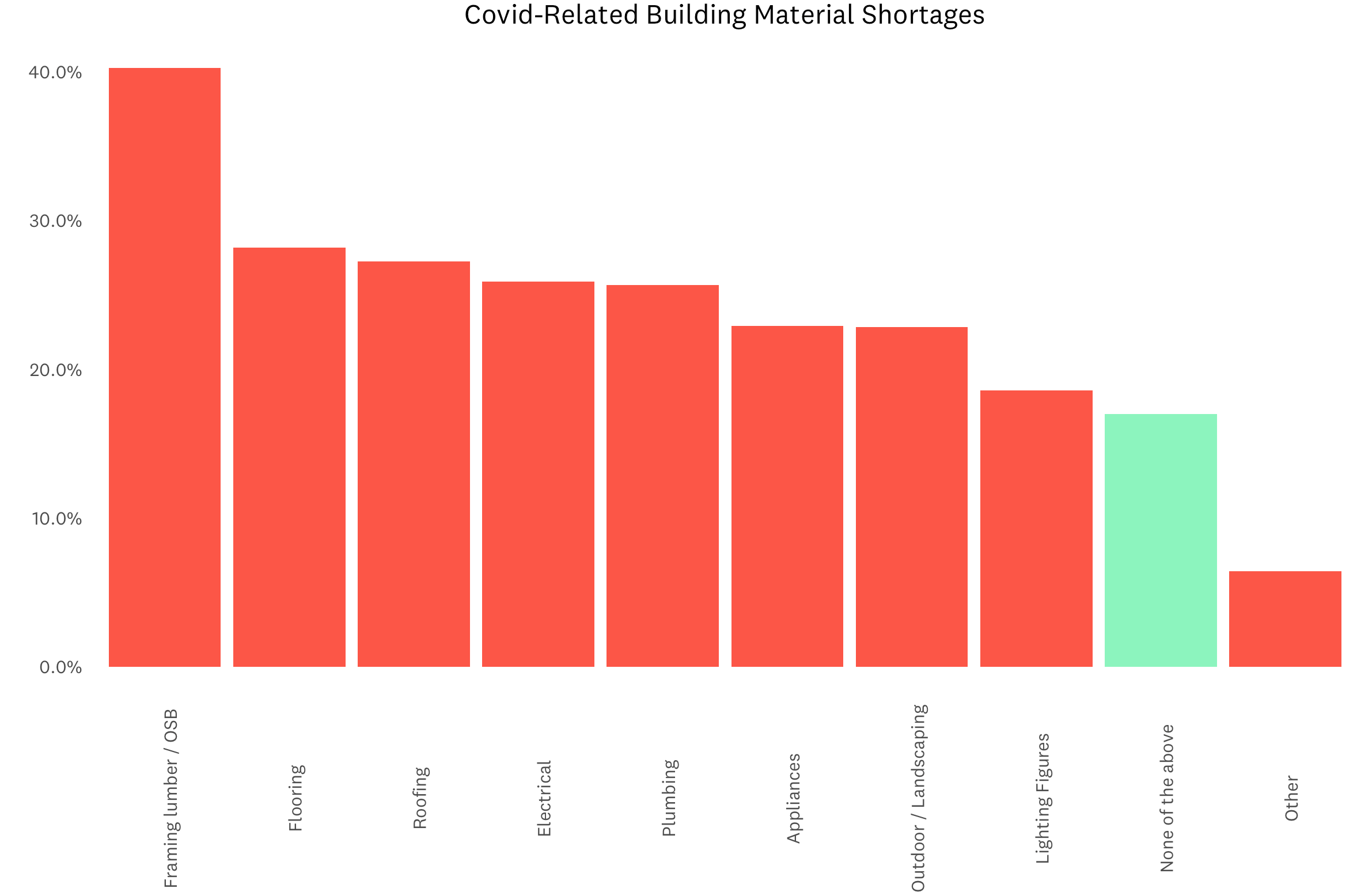

83% of skilled tradespeople faced some sort of material shortage over the last year, with the biggest issue being framing lumber and oriented strand board (OSB), commonly used for subflooring and siding in home additions and remodels. 40% of pros surveyed experienced shortages in framing lumber or OSB. 28% experienced shortages in flooring supplies, 27% in roofing materials, and a quarter (25%) in appliances, plumbing supplies and electrical supplies. These materials are all major inputs in both new home construction and remodeling. Most have lengthy supply chains, which were all susceptible to shipping backlogs at manufacturers, ports and rail yards.

These material shortages and supply chain disruptions impacted customer timelines and pros’ business funnels and pipelines. Project backlogs shrunk on average, with 53% of pros saying it was because of COVID-19. This was likely some combination of not wanting to assume committed pricing and materials risks due to the shortage issues and the confidence that the market is strong enough that more work can be easily found in the future.

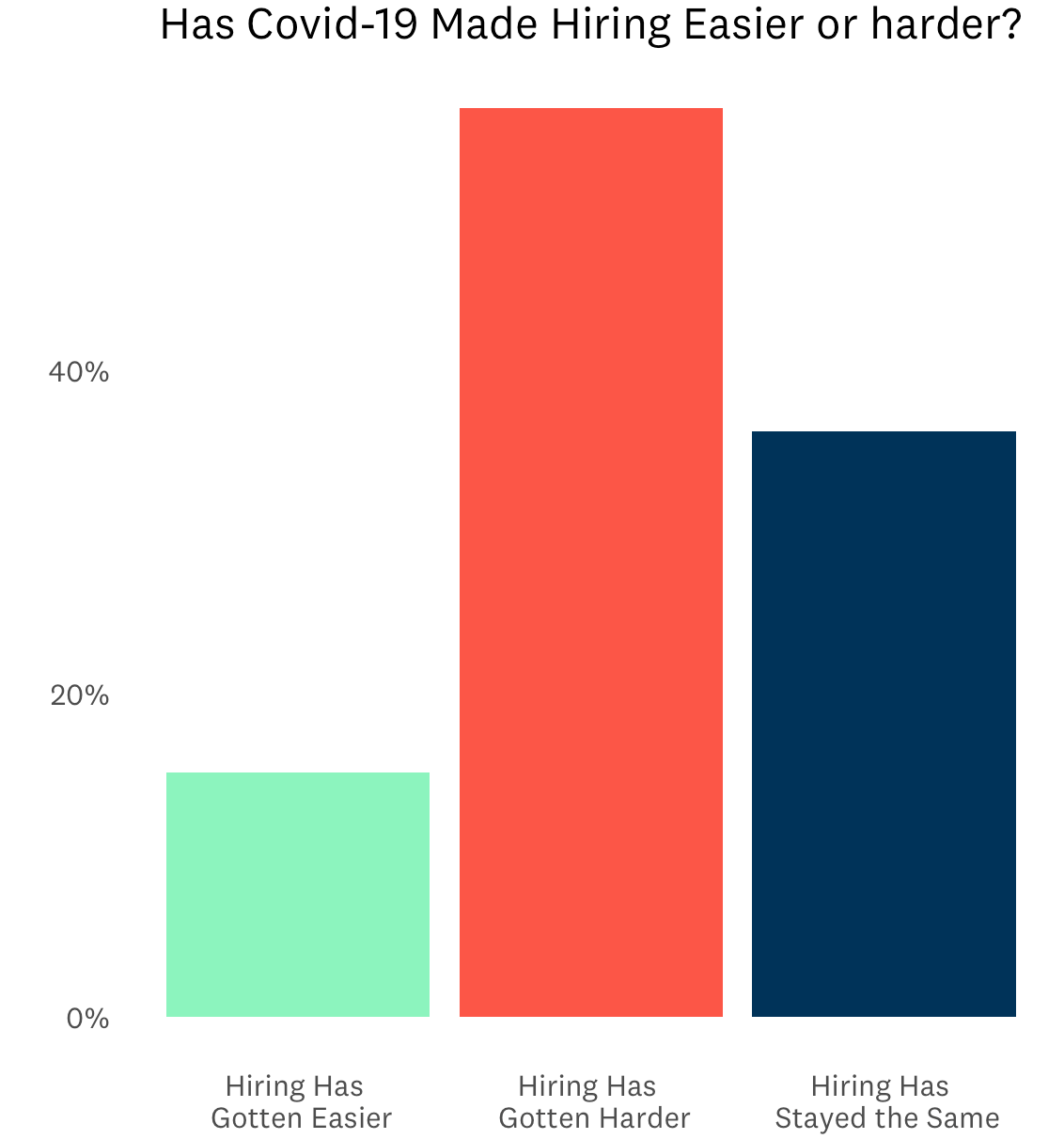

Material shortages and supply chain disruptions were major parts of the tradesperson’s daily work for much of 2020 and 2021, but not the only factors they saw impacted by the COVID-19 pandemic. The existing labor shortage is a chronic issue, but due to COVID-19, pros saw the problem grow more acute. 56% of pros said that COVID-19 has made hiring even harder. Very few pros, only 15%, thought COVID-19 had a positive impact in hiring.

To address some of these logistical challenges, as well as to boost both safety and long-term efficiency (which allows scarce labor to be stretched further), COVID-19 sped up rapid adoption of technology amongst tradespersons.

3.2 Widespread Adoption of Technology

Across the board, skilled tradespeople innovated and sped up their adoption of new tools.

In the last year, 21% of skilled tradespeople adopted third-party financing for clients, 36% of pros adopted new tools for meetings, 39% added new tools for quotes, 42% adopted digital tools for planning and 47%, nearly half, added solutions for digital payments.

Collectively, every pro we surveyed made some sort of technological change in the last year. What each one of these different forms of technology have in common is that they each reduce friction in the transaction process, free up time for more productive work (the actual improvement/maintenance of people’s homes) and are widely used across other industries. Often later to adopting technology-first solutions than other industries, home services trades saw a boost in adoption over the last year.

While the pandemic offered a strong impetus for technological change, the impact could be long lasting, both because more modern tools will help dissuade potential attitudes about the skilled trades as not being up to date with the latest technology, as well as because they allow pros more time throughout the day, shifting their focus from administrative details to the productive work of maintaining and improving our homes.

Summary

This is the most interesting time for the skilled trades in modern history both because of the pandemic and because of the “Great Resignation.”

The Great Resignation could provide great opportunities for skilled tradespeople in America. Study after study, survey after survey is tapping into the growing discontent amongst American workers. People want to feel more connected to their jobs and to their work.

That connection between the work and the meaning and value of work has always been strong with skilled trades and is now more relevant than ever before. This is the opportunity: redefine the trades as craft and begin to eat away at the challenges of perception around this essential, vibrant and important work.

The trades have a wonderful array of benefits to offer, there is a pronounced shortage of skilled labor, and opportunity abounds for the innovative entrepreneurs that can grow and scale businesses in this unique time.

While recruitment needs to be more adaptive to the shortages and tap into the current labor movement, the trades are innovating. The pandemic resulted in severe supply and labor constraints across virtually every sector; however, tradespeople have rapidly adapted to the situation with new tools, technology, payment options and planning methods.

As the economy continues to grow this decade, people will choose to spend that new wealth on the home.

All this pent-up and planned spending on the home needs a supply of available skilled tradespeople to do the work, and the opportunities are limitless for those willing to tackle the industry’s challenges in the years to come.

Methodology

This research report was compiled based on Angi analysis of American Community Survey (ACS) Public Use Microdata and two surveys of 2,400 skilled tradespeople conducted between August 4th and August 18th, 2021. The survey panels were provided by Pollfish, a 3rd party survey and panel provider that delivers online surveys globally through mobile apps and the mobile web along with the desktop web. Each survey had 1,200 respondents and a margin of error of ±3.0% at a 95% confidence level. The sample targeted skilled tradespeople and no post sample weighting was applied.

1 Hanson, Melanie. Average Cost of College Tuition. EducationData.org. Retrieved from: https://educationdata.org/average-cost-of-college/.

2 Center for Microeconomic Data. Household Debt and Credit Report. Federal Reserve Bank of New York. Retrieved from: https://www.newyorkfed.org/microeconomics/hhdc

3 Smith, Aaron. Searching for Work in the Digital Era. Pew Research Center. Retrieved from: https://www.pewresearch.org/internet/2015/11/19/searching-for-work-in-the-digital-era/.

4 Shields, Jon. Over 98% of Fortune 500 Companies Use Applicant Tracking Systems. Jobscan. Retrieved from: https://www.jobscan.co/blog/fortune-500-use-applicant-tracking-systems/.

Press & Media Inquiries

Press & Media Inquiries Angi Economics

Angi Economics