Most home remodeling projects, especially popular home improvements like bathrooms and kitchens, have substantial long-term returns in areas such as quality of life, increased resale value, and lower energy costs. The problem is that these same improvements often come with hefty price tags, and few homeowners have that kind of cash floating around to pay for everything up front. Financing home remodeling is the answer. It’s wise to tap into the benefits of home remodels sooner rather than later, and financing makes it possible for you to do so.

Wondering how much your remodel may cost? Estimate project prices our home remodel cost calculator.

Financing Home Remodeling Is Easier than Ever.

Fortunately, it’s easier than ever to finance home improvements. Options such as refinancing, home equity lines of credit, home equity loans, second mortgages, and contractor loans are all available to you as a homeowner. Unfortunately, all these options also make it more confusing than ever to decide what type of loan to take. What follows is a description of some of the most popular financing options, their benefits, and their drawbacks, to help you decide which is the best for you.

Contractor Loans

Contractor loans are loans set up directly through the contractor, instead of you seeking out a third party lender. In most cases, the loan is actually issued by a bank or finance company that the contractor works with. These loans save you the hassle of tracking down the funds yourself, but you need to keep an eye out for unfavorable terms. Never sign onto a loan from a contractor, or any other lender for that matter, without thoroughly looking over the contract and making sure you understand, and can live with, all the terms and conditions.

Refinancing and Second Mortgages

Refinancing and taking out second mortgages are two of the most popular ways of financing home remodeling. They are especially good options if interest rates have dropped since you took out your original mortgage. If interest rates for mortgages are significantly higher, you might want to look at other financing options. Also, pay close attention to closing costs. They can be substantial, moreso with refinancing, and you should take them into account when deciding if refinancing or taking out a second mortgage is the best way to pay for your home remodels.

Home Equity Loans and Lines of Credit

Two of the most popular ways of financing home remodeling are home equity loans and home equity lines of credit. Both are based on the amount of equity you’ve built up in your home (the difference between how much your home is worth and the amount of money you still owe on it), and can be excellent sources of financing for home remodels. A home equity loan is a set amount of money that you borrow and agree to pay back. A home equity line of credit is more like a debit account made available to you that allows you access to any funds up to a certain amount. Both are great financing options, though with a line of credit you’ll only pay for the money you actually borrow (hopefully less than the maximum allowed amount), making lines of credit a more flexible option.

Ready to start your Improvement Financing?

Find ProsTalk to a Lender

When it comes to financing home remodeling, the best way to ensure you’re getting the best possible loan is to talk to a bank, credit union, financial consultant, or professional lender. They’ll sit down with you to compare different options, rates, terms, and conditions, in order to figure out which is the best financing option to get your remodeling project up and running as soon as possible.

Raise the Value of Your Home with These 7 Remodeling Tips

Raise the Value of Your Home with These 7 Remodeling Tips  8 Steps to Good Credit

8 Steps to Good Credit  How to Recoup Remodeling & Addition Investments

How to Recoup Remodeling & Addition Investments  New Homeowner? Here Is What You Need to Know

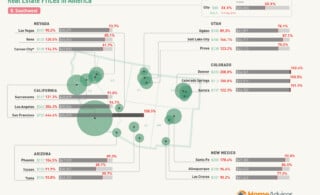

New Homeowner? Here Is What You Need to Know  Real Estate Affordability Across America – How Does Your City Stack Up?

Real Estate Affordability Across America – How Does Your City Stack Up?

Are You Familiar With This Topic? Share Your Experience.