Greetings,

You may have noticed: American homes are looking good. And there’s good reason for it.

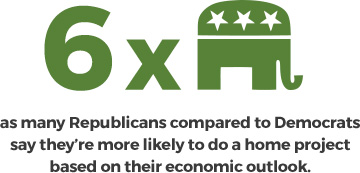

According to the results of HomeAdvisor’s 2017 True Cost Survey, the average homeowner has spent nearly 60 percent more on home projects over the past 12 months than in the 12 months prior. And, we’ve seen a 7 percent¹ increase in total nationwide expenditures on home improvement — with homeowners tackling bigger-ticket projects like kitchen and bath remodels and exterior renovations.

What’s more, there’s more to come. Coming off this huge increase in 2016, just 37 percent of homeowners report plans to spend less on home improvement in 2017, while nearly two-thirds say they plan to spend the same amount or more. People are feeling positive about both their homes’ values and the prospects for the economy. And, with this mindset as their foundation, they’re planning to take on more major home improvement projects.

In HomeAdvisor’s 2017 True Cost Report, I’ve detailed and provided some context around the findings of our annual True Cost Survey — a survey designed to take the pulse on home improvement spending in America and provide insight into homeowner spending trends. Further, I’ve explored some of the greater macro political and economic factors influencing home project decision-making, including interest rates, political party affiliation and consumer confidence.

Overall, I believe that any headwinds from economic and political changes will be minor. Bottom line: We’re forecasting greater increases in home improvement spending for many years to come.

Happy reading!

Brad Hunter

Chief Economist, HomeAdvisor

True Cost Report

Highlights

- Homeowners are spending more on home improvement.

- Baby boomers and millennials are leading the charge in home improvement.

- Millennials tend to DIY.

- Age of home and length of residence matter.

- Home improvement is gaining the most traction in the West and Northeast.

- People are planning for more home improvements in the next 12 months.

- Consumer confidence will drive home improvement.

- Home improvement spending rises amid political anxiety.

Key Survey Findings

1. Current Home Improvement Spending Trends:

Homeowners are spending more on home improvement. Homeowners tackled more home improvement projects from

February 2016 through February 2017 than they did from February 2015 through February 2016. What’s more, they spent an average of roughly $1,850 more on home improvement projects.

Baby boomers and millennials are leading the charge. Baby boomers are doing more home projects — and spending more money — than any other group of homeowners, followed closely by millennials.

Millennials tend to DIY. Home project spending is up among millennials, but less than half report always hiring a professional to help complete home improvement projects — in part because they’d have to save for or finance a home improvement, and in part because they’re uncertain they’re being charged a fair price.

Age of home and length of residence matter. Homeowners who’ve lived in their homes for less than six years spent the most on home improvement projects last year, followed by those who’ve lived in their homes longer than 11 years. Homeowners who’ve lived in their homes for six to 10 years, on the other hand, spent the least on home improvement projects.

Home improvement is gaining the most traction in the West and Northeast. Homeowners in the West and Northeast are spending the most on home improvement. And, because they’re accruing some of the highest equity, they’re also taking out the most home equity loans to complete projects.

2. Future Home Improvement Spending Outlook:

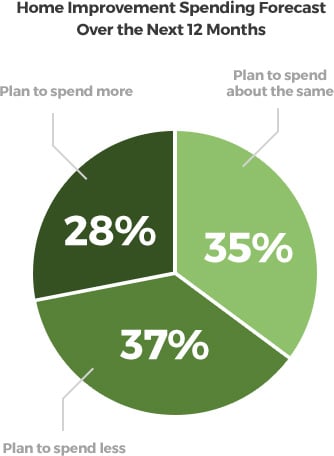

People are planning for more. Nearly two-thirds of homeowners report plans to spend the same amount or more on home improvement projects in 2017 than they spent in 2016.

Home improvement spending rises among political anxiety. The presidential administration and political affiliation are not negatively impacting homeowners’ willingness to take on home projects. While just 35 percent of homeowners are confident that their personal economic situation will improve as a result of policies enacted by the Trump administration, more than 80 percent of homeowners maintain they are planning to complete as many or more home projects in the next 12 months.

Section 1:

Current Home Improvement Spending Trends

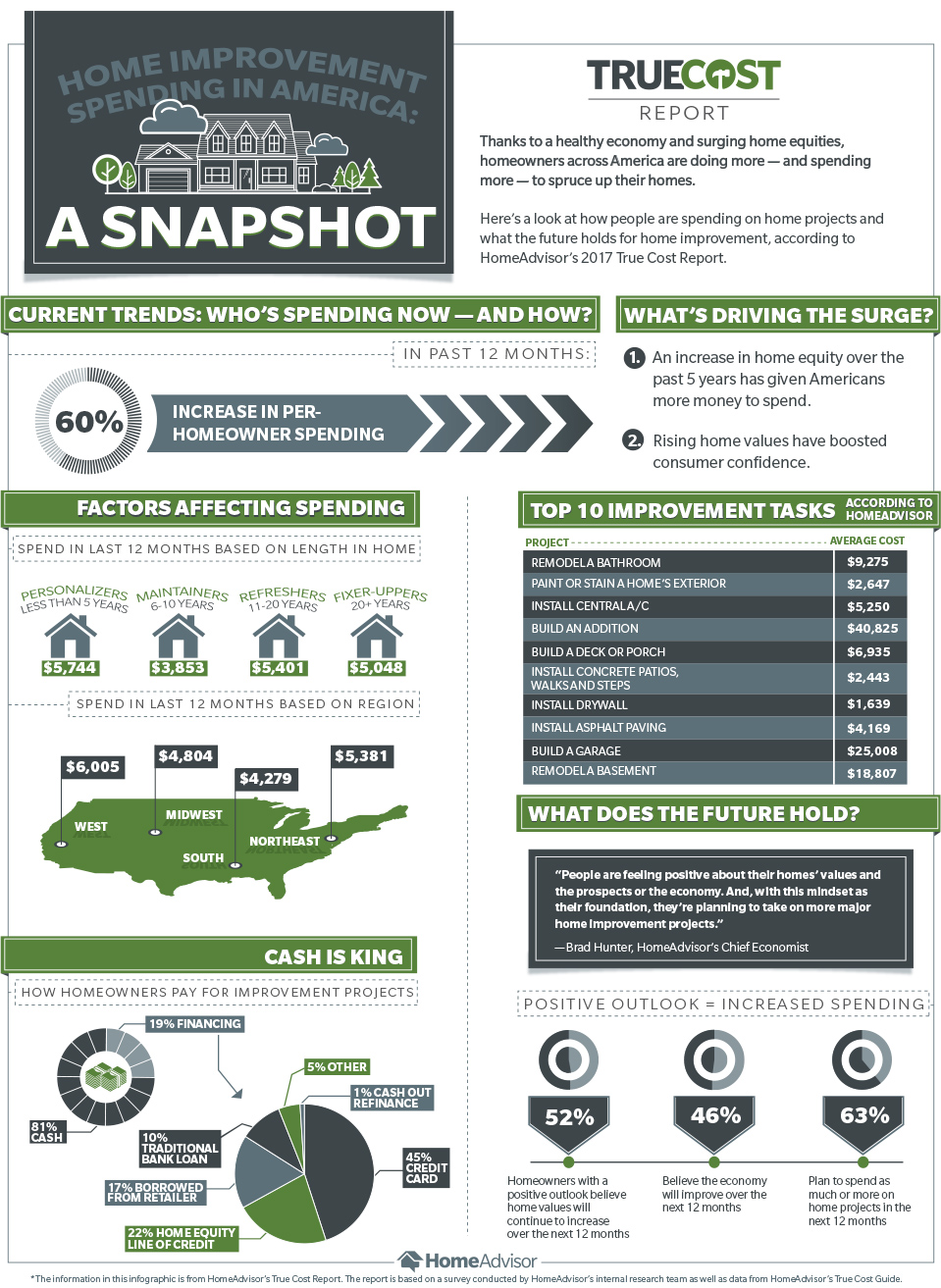

Homeowners across the United States are completing more home projects and spending more money on home improvement and repairs. Overall, homeowners report spending an average of $5,157 on home projects within the last 12 months — representing an increase of $1,869 over the previous 12 months. Moreover, nearly two-thirds of homeowners say they’ll spend as much or more in the coming year.

The upsurge in home improvement spending can largely be attributed to two important factors: 1. A two-fold increase in homeowner equity over the past five years has allowed homeowners to spend money on the costly discretionary projects they had to put off during the recession, and 2. The overall rise in home values has boosted consumer confidence and homeowners’ sense of their own financial well-being. Of course, there are also many important generational, regional and conditional

The upsurge in home improvement spending can largely be attributed to two important factors: 1. A two-fold increase in homeowner equity over the past five years has allowed homeowners to spend money on the costly discretionary projects they had to put off during the recession, and 2. The overall rise in home values has boosted consumer confidence and homeowners’ sense of their own financial well-being. Of course, there are also many important generational, regional and conditional

factors in play.

This section provides a snapshot of who is spending the most on home improvement and how homeowners are securing and allocating their funds — further exploring the ways in which age, location and length of residence affect homeowner spending in a market ripe for home improvement.

Who is Spending on Home Improvement?

Boomers and Millennials are Leading the Charge.

From a generational standpoint, baby boomers are completing the most projects and spending the most home improvement dollars — presumably because they have substantial home equity, peak-of-career incomes, and capital stashed in savings and stock portfolios.

“What’s more, millennials are already outspending Generation X homeowners, who were hit the hardest by the home price collapse of 2006 through 2009, on a per-household basis.”

But the millennial generation is trailing close behind. Baby boomers report spending an average of $5,604 on home improvement projects in the last 12 months, while millennials report spending an average of $5,046. What’s more, millennials are already outspending Generation X homeowners, who were hit the hardest by the home price collapse of 2006 through 2009, on a per-household basis.

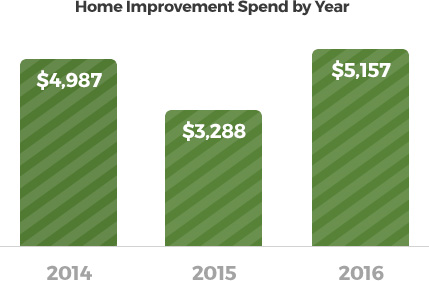

Interestingly, while millennials are increasing their home improvement spend, they are the least likely among homeowners to feel confident that professionals are charging them a fair price for projects. On average, 58 percent of millennial homeowners feel they are being charged a fair price, compared with 64 percent of Generation X homeowners and 81 percent of baby boomer homeowners. Consumers in general are afraid of overpaying for home projects, but most younger homeowners lack the experience of older generations when it comes to dealing with home repairs and renovations. That said, many millennial homebuyers are purchasing lower-priced, fixer-upper homes to gain homeowner status. And, when they do, they tend to take measures to personalize the space for their own self-expression and tastes — even if it takes a few years of gradual spending and effort to do it.

We can expect the millennial generation to exert greater influence in the home improvement market over the next five years or so — and to have a massive impact on overall home improvement spending over the next 10 years.

We’re already seeing the leading edge of this generation — people in their early 30s — getting married and having children at a rate similar to that of Generation X. And we’ll soon see the younger millennials follow suit. As these younger millennials start having families and purchasing more single-family homes, they’ll start spending money to repair, enhance and maintain their homes in greater numbers.

We’re already seeing the leading edge of this generation — people in their early 30s — getting married and having children at a rate similar to that of Generation X. And we’ll soon see the younger millennials follow suit. As these younger millennials start having families and purchasing more single-family homes, they’ll start spending money to repair, enhance and maintain their homes in greater numbers.

In the nearer term, as we see more millennials enter the housing market, we may expect to see the ‘do-it-yourself’ share grow faster than the ‘do it for me’ share. As the results of our True Cost Survey suggest, homeowners are more likely to hire a pro for every project as they get older — and as they become more financially well off. Currently, just 40 percent of millennial homeowners say they’ll hire a pro for every project, compared with 53 percent of baby boomers. So, about seven years from now, when more millennials start hitting age 35, we can expect an increased demand among millennials for professional home services.

Personalizers and Refreshers Tend to Spend and Do More

The age of a home and the length of its owners’ occupancy also factor into home improvement spending. Interestingly, the highest home improvement spending comes from homeowners who’ve lived in their homes for five years or less and homeowners who’ve lived in their homes for more than 11 years.

This indicates that homeowners who have lived in a home for six to 10 years — the Maintainers — have settled into their homes, not yet needing to address long-term wear and tear while having spent the first few years pursuing updates and adding their personal touches. And homeowners who’ve lived in their homes for 11 years or longer — the Refreshers and the Fixer-uppers — are likely to encounter necessary updates and repairs — such as new appliances or roof restoration — for which they may be able to pay with accumulated home equity. (This explains why this group of homeowners plans to spend more in the coming year than in the previous year, while other homeowners plan to spend about the same or less.) And newer homeowners — millennials, in particular — will be more likely to pursue home projects to personalize or upgrade their recently acquired spaces.

This indicates that homeowners who have lived in a home for six to 10 years — the Maintainers — have settled into their homes, not yet needing to address long-term wear and tear while having spent the first few years pursuing updates and adding their personal touches. And homeowners who’ve lived in their homes for 11 years or longer — the Refreshers and the Fixer-uppers — are likely to encounter necessary updates and repairs — such as new appliances or roof restoration — for which they may be able to pay with accumulated home equity. (This explains why this group of homeowners plans to spend more in the coming year than in the previous year, while other homeowners plan to spend about the same or less.) And newer homeowners — millennials, in particular — will be more likely to pursue home projects to personalize or upgrade their recently acquired spaces.

The rate of turnover, or churn, is another important determinant. When a house turns over, there are two different spikes in home improvement spending:

“The first is driven by the seller, who may be sprucing up a home or readying it for inspection; and the second is driven by the buyer, who may want to improve the home and tackle projects to make it their own.”

In a healthy housing market, as we’re seeing now, churn will account for a substantial uptick in home project expenditures.

Spending Is Highest in the West and Northeastern Markets

Homeowners in the West and Northeast are spending more than homeowners in the South and Midwest on home improvement, as rising home values in these areas are providing significant home equity to pay for projects. Recent research from Harvard’s Joint Center for Housing Studies² confirms that homeowners in Portland; Seattle; New York; Boston; Washington, D.C.; and Denver spend significantly more than people in most other major metros. These are markets in which home prices have, for the most part, strongly risen from already-high levels in the past two years.

Homeowners in the West and Northeast are spending more than homeowners in the South and Midwest on home improvement, as rising home values in these areas are providing significant home equity to pay for projects. Recent research from Harvard’s Joint Center for Housing Studies² confirms that homeowners in Portland; Seattle; New York; Boston; Washington, D.C.; and Denver spend significantly more than people in most other major metros. These are markets in which home prices have, for the most part, strongly risen from already-high levels in the past two years.

How Are Homeowners Securing and Allocating Their Funds?

Cash Is King, but Credit Card and Home Equity Financing Are Gaining Traction.

More than 80 percent of homeowners report paying for home improvement projects with cash on hand. But, of the nearly 20 percent who report using financing to pay for home improvement projects, 45 percent report using a credit card, and more than 20 percent report using home equity financing. This is consistent with last year’s findings, in which 45 percent of homeowners reported using a credit card and 25 percent reported using home equity financing to pay for projects.

Homeowners in the West and Northeast Rely Most on Home Equity Financing.

Homeowners in the West and Northeast regions are not only spending more on home improvement and home maintenance than homeowners in the South and Midwest, but per American Housing Survey data³, they are also taking out more home equity loans to pay for them — at an average of $100,000 and $80,000, respectively.

People Are Tackling Bigger, More Expensive Projects.

During and even after the recession, most homeowners delayed discretionary home projects and limited their spending to necessary maintenance and repair tasks. But as the dust settles, many homeowners are finding themselves better able to pay for long-deferred upgrades. In fact, massive percentage increases in homeowner equity have inspired many homeowners to add more high-dollar home projects  to their annual budgets — meaning that we’ll see an even greater increase in the 10 million kitchen remodels and 14 million bathroom remodels the National Kitchen & Bath Association (NKBA) report are already taking place each year⁴.

to their annual budgets — meaning that we’ll see an even greater increase in the 10 million kitchen remodels and 14 million bathroom remodels the National Kitchen & Bath Association (NKBA) report are already taking place each year⁴.

“Over the last 12 months, remodels, additions and exterior renovations have topped the list of HomeAdvisor’s most popular service requests, with homeowners spending an average of $1,869 more on home improvement projects over the year prior.”

What’s more, economists at the National Association of Home Builders, using their Remodeling Index (RMI)⁵, report that market conditions for firms doing major additions and alterations valued at $25,000 or more have improved at a faster rate since 2010 than that for firms doing smaller renovations and maintenance and repair projects. And, accoridng to NKBA, more than 10 percent of American homeowners completed a kitchen or bath remodeling project last year, with nearly half of homeowners paying betwee $20,000-$49,000 for a complete kitchen remodel and half of homeowners spending between $10,000-$29,999 for a complete bathroom remodel. What’s more, data from home improvement superstores like the Home Depot show that people are upgrading to better appliances, materials and fixtures.

Section 2:

Home Improvement Spending: Future Outlook

All signs point to increased home improvement spending in 2017 and beyond. Of course, there are a number of important factors that may sway future individual spending and, therefore, home improvement expenditures as a whole. To that end, this section provides a detailed summary of some of the macro financial and political factors influencing homeowner spending and offers an informed forecast of what we may expect to come.

Consumer Confidence:

The results of HomeAdvisor’s 2017 True Cost Survey show that nearly half of respondents believe the economy will improve over the next 12 months — and, of those respondents, more than 80 percent expect their home values to rise as a result. Correspondingly, more than half of homeowners overall believe their home values will improve over the next 12 months, indicating that most homeowners have a positive outlook on the housing market and home values as a whole.

Economic Outlook Influences Discretionary Spending.

People spend more money when they expect the economy to improve. So, when homeowners are confident that their home values and income levels will rise (as many do in an improving economy), they are more likely to go forward with projects that they might have deferred if they felt less financially secure.

Of course, most people who need to make necessary home repairs are going to do it regardless of their view of the economy. Nonetheless, there is a significant share of the population who foresees a change in their home improvement plans based on how they feel about the economy. Interestingly, our survey showed an almost even split between people whose outlook on the economy makes them more likely and those whose outlook makes them less likely to do a home improvement project in the next twelve months.

For some homeowners, economic outlook may significantly impact discretionary spending. Those with a more pessimistic view of the economy may choose to delay some projects, for example. Or, they may cancel plans to purchase a new home and instead make improvements to their existing home to accommodate changes in their needs and preferences. Increased availability of home equity loans and lines of credit facilitate these kinds of projects. But, most homeowners use savings to fund home improvement projects, rendering economic outlook, as well as current and future income levels, less critical.

Home Improvement Spending Rises Among Political Anxiety.

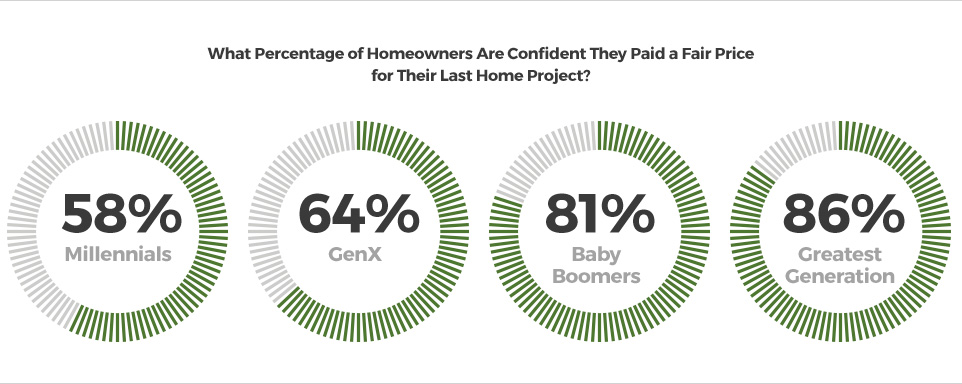

Since the election, we have seen Republicans adopt a rosier view of the economy than Democrats (whereas a year ago we found the opposite to be true) — and our research shows that Republicans are much more likely to complete a home improvement project in the next 12 months based on their confidence.

Interestingly, six times as many Republicans compared to Democrats say they’re more likely to do a home project based on their expectations of the Trump administration’s performance.

Interestingly, six times as many Republicans compared to Democrats say they’re more likely to do a home project based on their expectations of the Trump administration’s performance.

Republicans are also more bullish about an increase in home values, with 71 percent of Republicans believing that home values will increase over the next 12 months compared with 38 percent of Democrats and 53 percent of Independents.

Perhaps surprisingly, homeowners’ feelings about the presidential administration do not negatively affect homeowners’ willingness to take on home projects. While just 35 percent of homeowners are confident that their personal economic situation will improve as a result of policies enacted by the Trump administration, more than 80 percent maintain they are planning to complete as many or more home projects in the next 12 months.

Rising Interest Rates Could Actually Boost Home Improvement.

It’s a fact: Mortgage rates are going up from here. It’s just a question of how much and how fast. When the 30-year fixed mortgage rate gets back into the 5- to 6-percent range, homeowners with a 3.5 to 4 percent mortgage rate may be reluctant to sell their homes and move — even if they really want to. So, instead of moving, these homeowners may opt to improve, update or add onto their existing homes, thereby retaining their lower mortgage rates and further boosting home improvement spending nationwide.

Moreover, according to the results of the True Cost Survey, the costs associated with financing home improvement projects will not deter homeowners from tackling projects in the near term. Respondents indicated that a one-percentage-point increase in interest rates would not stop them from having work done on their homes. This may be attributed to the fact that the majority are paying for home projects with savings in lieu of financing. Also, many home projects — plumbing issues and roof damage, for example — will need to be done regardless of the financing costs.

Per-Homeowner Spending Will Hold Steady.

True Cost Survey respondents indicated varying plans for home improvement spending in 2017.

True Cost Survey respondents indicated varying plans for home improvement spending in 2017.

“Specifically, roughly 28 percent said they plan to spend more, 37 percent said they plan to spend less, and the largest share (35 percent) said they plan to spend about the same amount.”

That said, given a healthy economy and strong consumer confidence, there will be more people in a homeownership position in 2017 than there were in 2016. So, the aggregate amount of expenditure is forecast to rise. In fact, we are projecting an increase in home improvement, maintenance and repair spending in the 6 to 7 percent nominal range in 2017.

Of course, it is also important to note that people tend to underestimate the cost of home projects, suggesting that many of the people who plan to spend less may actually spend the same amount or more should unforeseen projects arise — or should planned improvements end up costing more than expected. This circumstance factors into our prediction that actual per-homeowner expenditures will continue to increase in 2017.

Infographic