HOME IMPROVEMENT TRADES GEARING UP FOR SMART TECH SURGE

Exclusive Industry Survey Examines Role of Home Service Professionals in Widespread Smart Home Deployment, Reveals Blueprint for Emerging Experts

By: Dan DiClerico, HomeAdvisor’s Smart Home Strategist

EXECUTIVE SUMMARY

The smart home has officially arrived. Some 30 million US homes are connected with at least one smart device (nearly doubling the total from 2015)1. And smart home hardware — including security cameras, door locks and lighting controls — is on track to generate $9 billion in sales in 20172. The rapid adoption of smart home devices is no doubt a boon to manufacturers and retailers. But it also begs the question: Is the home services industry ready for the millions of new consumers who will need help installing and servicing their smart home equipment? And, what’s more, how great an opportunity is there for professionals looking to enter the smart home space?

HomeAdvisor, operator of the largest home services marketplace across the globe and CEDIA, the global trade association for home technology design, manufacturing and installation companies, joined forces to answer those questions. Our experts partnered on an exclusive survey of 1,450 smart home installation and maintenance professionals — everyone from experienced, high-end custom installers to tech-savvy handymen — to explore the emergence of the smart home industry from the perspective of the pros who know it best. And we’re pleased to report that our findings present a blueprint that will help these professionals both break into and succeed in the ever-evolving smart home field.

KEY FINDINGS

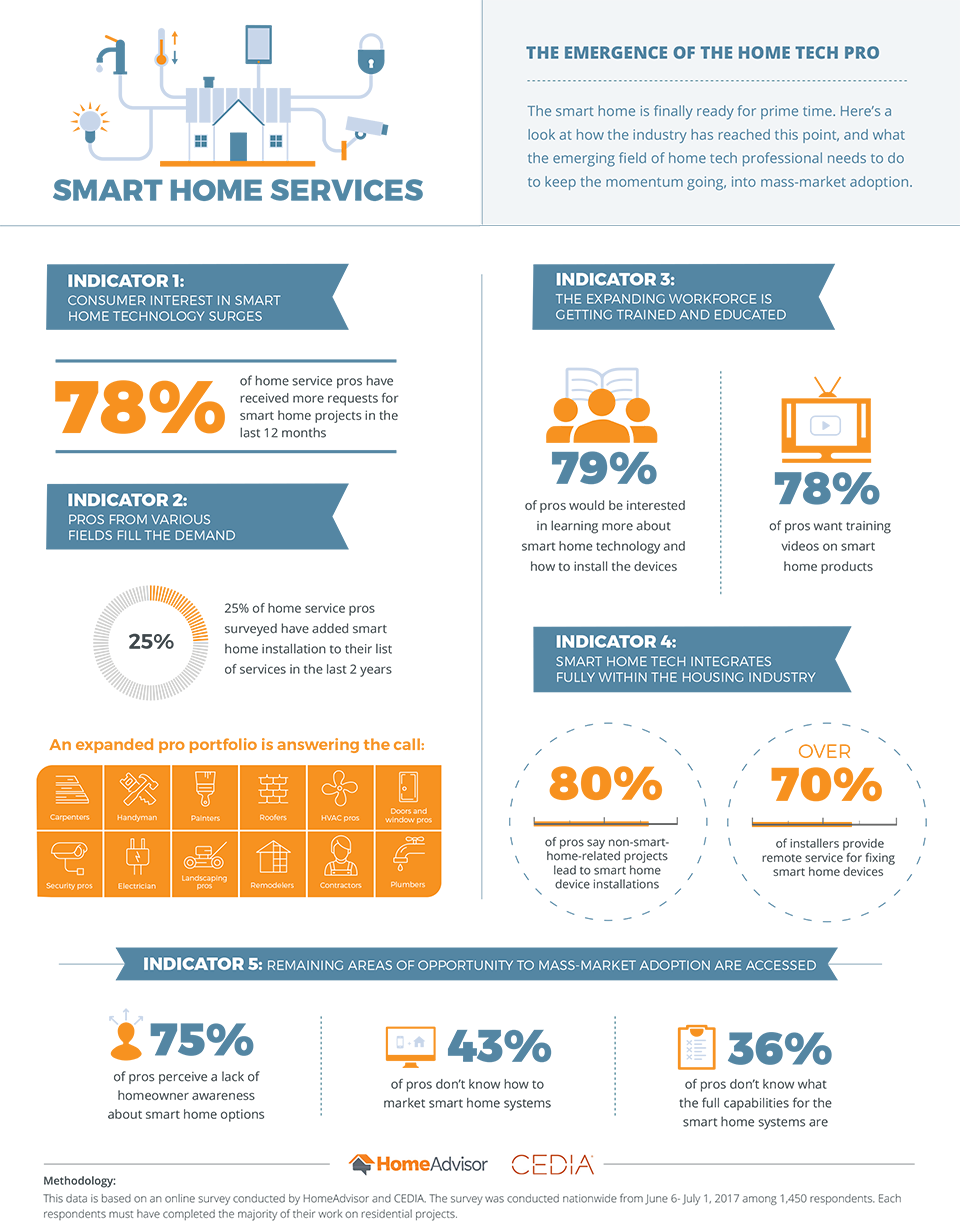

- Pros see a surge in smart home service requests. Three out of four professionals say they’ve gotten more smart home-related calls in the last year. The vast majority (83 percent) are receiving service requests at least once a month, if not weekly or even daily.

- Various tradespersons are providing smart home services. The smart home services industry is evolving. Where the space once belonged primarily to CEDIA pros specializing in custom audio visual (AV) installation, the proliferation of whole-home connectivity products has opened the doors to pros specializing in security, landscaping, and door and window installation, among the many other services HomeAdvisor members provide.

- Projects go beyond single-device installs. Smart home technology is quickly becoming intrinsic to the renovation process. More than half of survey respondents report doing smart home installations as part of larger remodeling projects. And six in 10 pros say non-smart home projects are now leading to smart home projects at least half of the time. About one-fifth of all pros report providing ongoing maintenance after installing smart home equipment.

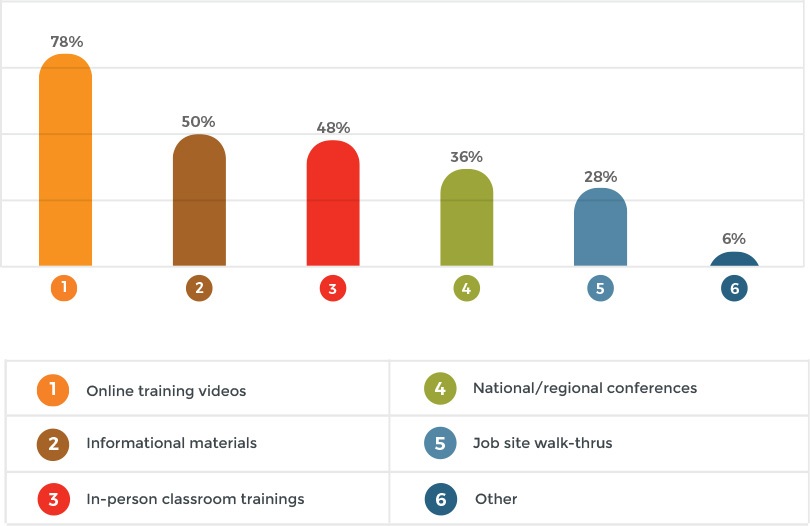

- Pros want more training and education. Home service professionals — particularly those entering the smart home space from other trades — are actively seeking to learn and know more about smart home products, installation and maintenance. And they’d most like to garner new knowledge from online training videos, informational materials and in-person classroom trainings.

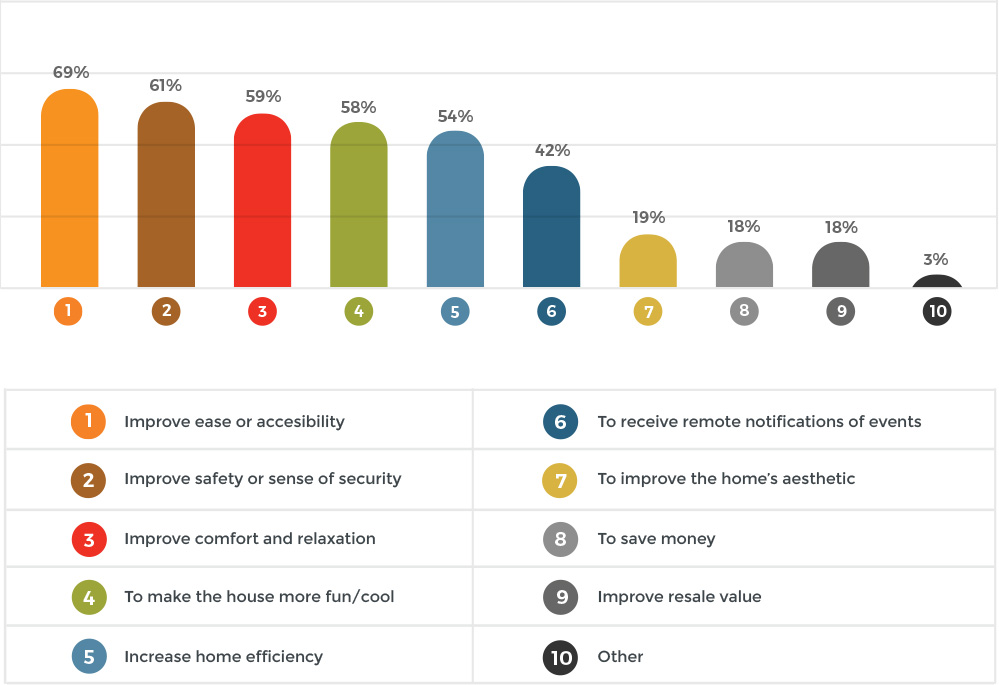

- Opportunity knocks. While one-quarter of respondents cite a lingering lack of consumer awareness as a significant barrier to the widespread adoption of smart home technology, they remain highly optimistic about the opportunities presented in the space. They are confident that better promotion of smart home technology’s main benefits — which they identify as ease-of-use, safety, and comfort — will further the need for dedicated smart home service professionals.

SECTION 1:

MEETING CURRENT DEMAND:

THE DAWN OF THE “DO-IT-FOR-ME” CONSUMER

Mass market smart home technology is often marketed as a DIY solution. And it’s true that some tech-savvy early adopters have been able to research and install their own connected devices. But as smart home adoption becomes more mainstream, we’re seeing a growing influx of service requests from the “do-it-for-me” smart home consumer. And with that growing influx comes a greater demand for qualified smart home service professionals.

Nearly eight in 10 survey respondents report seeing an increase in requests for smart home devices and installations in the past year — with 17 percent getting requests daily and nearly 30 percent getting requests a few times a week. In an earlier consumer survey, HomeAdvisor found that more than half of Americans are looking for outside support with the installation of their smart home products3 . And as smart home technology continues to proliferate, that number will only grow larger.

Here’s a look at how the home services trade is currently servicing the space:

Various tradespersons are providing smart home services. More than eight in 10 CEDIA respondents classify themselves as consumer electronics/audio visual (AV) installation providers while HomeAdvisor respondents report specializing in diverse trades such as AV/security; carpentry; contracting; electrical; handyman; heating, venting and air conditioning (HVAC); landscaping; painting; plumbing; remodeling; roofing; and doors and windows. Interestingly, an earlier HomeAdvisor survey of consumers reports that homeowners also seek smart home services through a diverse set of professionals: Roughly half of those respondents reported hiring a security/alarm company or electrician, while about one-quarter chose a general contractor, a heating and cooling contractor or a handyman.

Pros see promise across many smart product categories. Looking at the total smart home market, there’s a healthy combination of products with deep market penetration and products with room for growth. Pros say they most frequently install smart thermostats and lighting. And entertainment generates brisk business as well, with pros reporting smart TVs, multi-room speakers and connected TV sound bars next among the devices they regularly install. (Credit that to the fact that CEDIA member companies, now 3,700 strong, have deep roots in the automation and home entertainment spaces.) Other smart devices are slower to mature; just 20 percent of pros have installed a connected water shut-off valve, and around 40 percent have installed a smart smoke alarm.

Most Popular Reasons for Installing Smart Home Devices According to Pros

NAME THAT PROFESSIONAL

Consumers are increasingly turning to a variety of home improvement professionals, in addition to the tried-and-true AV installation pros and other technical experts, for help with their smart home needs. Now that electricians, handymen and remodeling contractors can be counted among smart home installers, the smart home professional needs a title that is universally recognized. Something akin to what plumbers are to indoor plumbing and what HVAC contractors are to heating and cooling systems. What to call this breed of home service professional? It’s a question that CEDIA members have grappled with over more than 25 years of existence, but even more so today.

Our survey asked pros in the smart home space how they self-identify. Terms like “integrator” and “custom installer” were popular, especially among long-established pros. But those terms don’t mean much to the average consumer. Conversely, “smart home professional” is too general. “Home technology professional” resonated with pros and is descriptive enough for the layperson to understand. So the smart home industry may benefit from adopting “home technology professional,” or “home tech pro” for short, as the name for housing’s newest trade.

SECTION 2:

BUILDING SMART BUSINESSES:

GROWTH STRATEGIES FOR HOME TECH PROS

CEDIA forecasts that the installers’ market, estimated to have reached $17-$20 billion in 2016, will double — maybe even triple — in the next 10 years. Millennials are a big driver for the optimism. They’ve not only led the early smart home adoption phase, but Harvard’s Joint Center for Housing Studies says they’re also the largest potential home buying cohort. In fact, they say they’re on pace to total nearly 50 million households by the year 20354. Put those two factors together, and it’s clear that millennials are poised to lead smart home adoption for decades to come.

Of course, home tech pros must be able to speak to all demographics, including Gen Xers and baby boomers, who together make up 140 million Americans5. These groups may be slower to adopt smart home technologies than millennials, but their service needs are mounting. As baby boomers retire, they’re making more home modifications for aging in place, as well as for general comfort and entertainment. And their growing interest in smart home products will further expand the market.

HOME TECH PROS WILL FIND THE BEST SUCCESS WITH A THREE-PRONGED APPROACH

1. Play the long game. Home automation used to be a niche market for luxury consumers. But its migration into the mainstream is making it a standard housing feature in new construction and remodeling alike. Our survey found that more than half of smart home installations are part of a larger remodeling project. What’s more, 53 percent of professionals report a smart home project leading to a non-smart home project at least half of the time.

As the smart home crosses into the mass market, many pros — including electricians, HVAC experts and handymen — will be crossing over from other trades. Their success, and the success of the profession in general, will come down to their ability to integrate smart technology into their existing skill sets and expertise.

Forward-thinking home service professionals are already leveraging the smart home upsell. “Let’s say an electrician is hired to install a smart thermostat,” says Ryan Herd, a CEDIA member and author of “Join the Smart Home Revolution: Make Your Home Safe, Efficient, and More Fun.” “If that pro knows how to combine the thermostat with a smart shading system, the total energy efficiency gain might be tripled.” This value-add is what makes smart home technology such a compelling business opportunity for the home improvement industry.

2. Build a scalable business. Because home automation started as a luxury feature, a lot of pros who work in the space are accustomed to servicing large-scale projects. According to CEDIA’s 2016 CEDIA Size and Scope of the Residential Electronics Systems Market report, the average project cost for CEDIA system integrators and audio video firms was $36,600 in 20166. But the emerging smart home consumer (i.e., the “do-it-for-me” consumer) is working with a different budget — maybe $1,500 for the installation of a suite of smart home devices, including a smart lock, thermostat, camera, lighting starter kit and digital assistant.

Fortunately, more than half (56 percent) of the pros we surveyed said they could take on jobs for $1,500 or less and still sustain a profitable business. And manufacturers are hungry for home tech pros who will service smaller projects. “We are definitely seeing a small tide of professionals from the various trades who are interested in learning the new technology,” says Mitchell Klein, executive director of the Z-Wave alliance, a consortium of IoT companies using the Z-Wave communication technology. “But a lot more of them will need to get on board.”

Of course, beyond overcoming a fear of the technology — and learning how to install it both confidently and skillfully to the satisfaction of their customers — home tech pros must find innovative ways to scale their businesses. Interestingly, our survey found that nearly 70 percent of professionals are providing remote service, for which 28 percent charge a fee. Not only do remote servicing and monitoring technologies offer reduced labor demands, but more remote tools are also coming to market — some that, for around $100 a month, will allow home tech pros to resolve many of their clients’ smart home issues without sending a truck to the house.

3. Outsmart the skilled labor shortage. Many home tech pros are interested in growing their businesses. The challenge is building a workforce. In fact, at both HomeAdvisor and CEDIA, the biggest pain point we hear from our member professionals is that they can’t find enough qualified workers to keep up with the demand for their services.

This labor shortage is not unique to smart homes; in the Q2 2017 HomeAdvisor Farnsworth Index over half of professionals surveyed reported trouble hiring skilled laborers in the last 12 months7. But it’s compounded by the fact that so much of the technology is new and evolving. We don’t see knowledge being handed down from one generation to the next in family businesses, the way it is done in other trades, for example. But with the right entrepreneurial spirit, this challenge can become an opportunity — at least until the industry matures.

SECTION 3:

BRIDGING THE GAP:

BUILDING A NATIONWIDE NETWORK OF QUALIFIED HOME TECH PROS

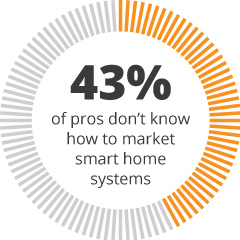

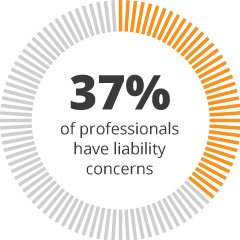

Home tech pros, both seasoned and novice, are in a unique position. Consumer demand for support with the installation and maintenance of smart home equipment is growing. But people moving into this field must be well-trained. And they must master new technologies amidst a worsening skilled labor shortage, which stunts the ability of many businesses to scale for the demand. Compounding this challenge is a lack of consumer awareness regarding smart tech benefits, a lack of resources for knowledge-seeking home service professionals, and a lack of know-how when it comes to how to market smart home services.

Here’s a deeper look at the chief barriers to widespread smart home deployment, as well as how the industry can work together to overcome them:

1. Too many consumers are still in the dark. Our survey asked pros about the barriers keeping their companies from doing more smart home installations. Three out of four pros cited lack of homeowner awareness as their chief barrier to expansion — the biggest barrier of all. While home tech pros can help bridge the awareness gap, the responsibility is also on manufacturers, who are well positioned to educate consumers on the benefits of the smart home. Some are already taking up the call. Honeywell, for example, has partnered with HomeAdvisor to connect Honeywell Total Connect Comfort users with prescreened service professionals for HVAC, plumbing, electrical, handyman and other services.

Biggest Barriers for Offering Smart Home Device Installations

2. Pros need more education too. Home service professionals are actively seeking to learn and know more about smart home products, installation and maintenance. CEDIA does a solid job educating both industry entrants and veterans, and it has started working with other trade groups to do the same — offering special training seminars to plumbers and HVAC and security contractors, for example. But the entire industry — including manufacturers, retailers and home service marketplaces — must join in scaling up on education and outreach. According to the results of our survey, eight in 10 pros prefer online videos to other training tools. And about half of survey respondents said they would be interested in receiving informational materials and in- person classroom training.

Most Popular Ways Professionals Want to Learn about Smart Home Products

3. Home tech pros need better marketing. Once consumer awareness is where it needs to be and a fully trained home tech workforce is in place, the last hurdle is bringing the two groups together. Respondents identified not knowing how to market home tech systems as another key barrier to expansion. Marketing strategies must be folded into training and education programs to address this problem. And home tech pros don’t just have to learn how to market to consumers; they must also be able to communicate the value of smart home technology to other housing industry pros, including real estate agents, appraisers and inspectors, as well as architects and builders.

CONCLUSION

Twenty seven years after CEDIA formed to promote and nurture the residential electronics market, smart homes are becoming a reality at every price level. And 30 million households enjoy improved comfort, ease-of-use, accessibility, efficiency and security as result. But that still leaves more than 100 million households in a less-than-optimal “unconnected” state.

Reaching the early smart home adopters was the easy part. Getting to the 100-million majority will require a concerted effort by the entire industry, including manufacturers committed to ongoing product innovation and retailers who can educate consumers on the benefits of the smart home. The home tech pro is the last, most critical link in the process. And HomeAdvisor, with its 14 million-plus service requests a year, is excited to team up with CEDIA and other industry groups to find and execute on a solution.

There are three key takeaways from our survey:

1. There is growing consumer demand for smart home services at all levels — and a need for a nationwide network of home technology professionals to serve them.

2. There is a roadmap and a trade association for pros gearing up to service this growing demand.

3. There is tremendous interest and opportunity within the home services sector to build programs and partnerships to support a smart home services network.

The goal of this report is not to connect every dot, but rather to lay out a beginning strategy for the emergence of a home technology profession. Once that vital service component is in place, the smart home’s decades-long journey towards full- market readiness will be complete.