April 11, 2017 We at HomeAdvisor have just launched a new quarterly index of sentiment among home improvement contractors. In collaboration with The Farnsworth Group, we surveyed 1,744 companies, asking their leadership about their current and expected future business prospects. For more comprehensive results, methodology, and survey dates, explore the detailed data, and watch for ongoing quarterly updates as we continue to gauge and monitor the strength of this $400 billion chunk of the economy.

We at HomeAdvisor have just launched a new quarterly index of sentiment among home improvement contractors. In collaboration with The Farnsworth Group, we surveyed 1,744 companies, asking their leadership about their current and expected future business prospects. For more comprehensive results, methodology, and survey dates, explore the detailed data, and watch for ongoing quarterly updates as we continue to gauge and monitor the strength of this $400 billion chunk of the economy.

Here are some high-level takeaways (we have these results broken out by type of contractor as well, found via the detailed data link).

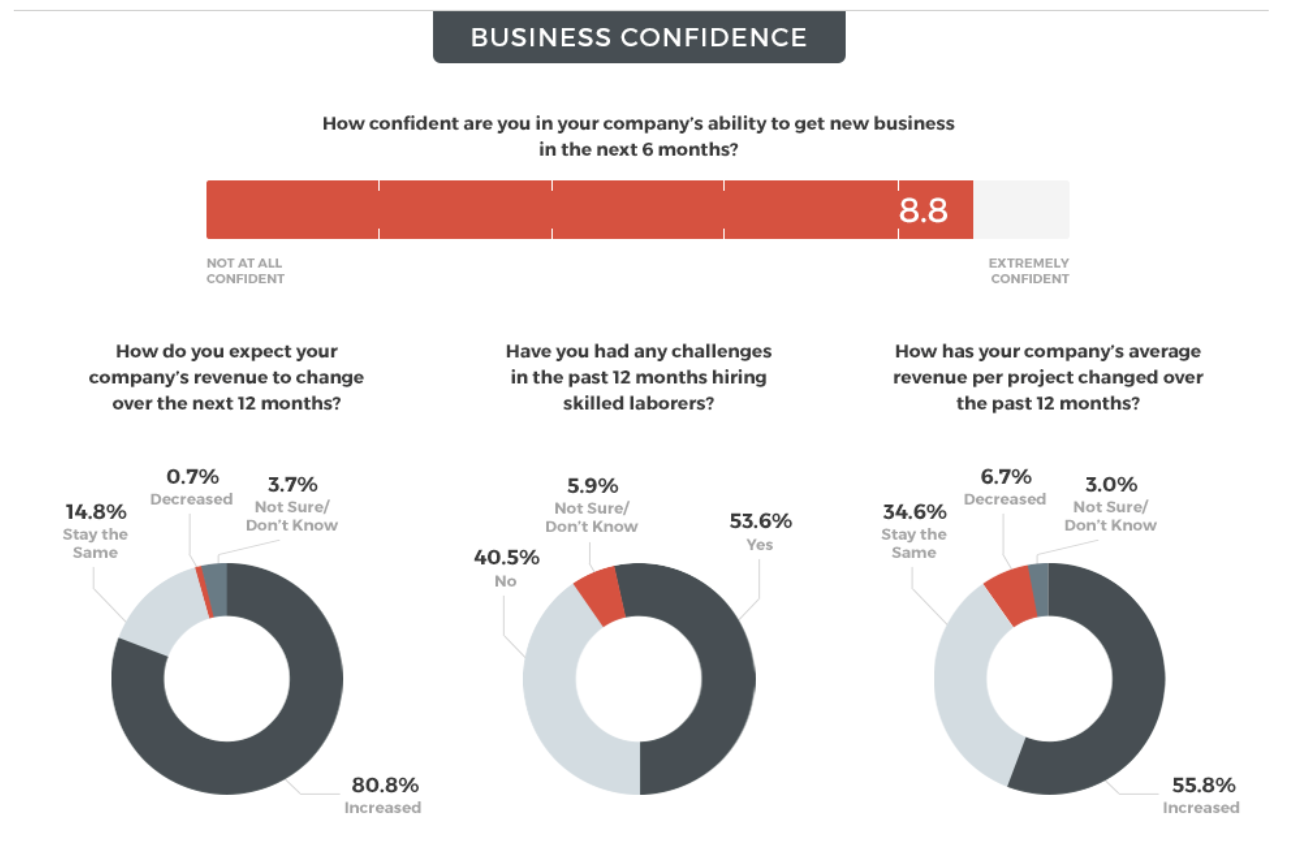

- The owners and managers of home improvement companies are feeling extremely confident about their business prospects these days. When asked in the first quarter of 2017, on a scale of 1-10, “how confident are you in your company’s ability to get new business in the next 6 months,” 80.1% of respondents answered 8,9, or 10. Even more dramatic, 10.6% said “9”, and fully 55.1% said “10 out of 10.”

- Revenue growth in the industry is robust, and is expected to remain extremely strong. When asked how they expect their company revenue to change over the next twelve months, 80.8% said that revenues will go up. Within that group, the most common expectation was that revenues will rise by between 11% and 20%. The next-most-common projection for revenue growth was 21% to 30%!

- Most respondents said that they are having trouble hiring enough skilled laborers. They said that if not for the labor shortage, they would be able to grow their revenues by an additional 11%-20%.

- Homeowners are starting to tackle larger projects for their home, now that they are feeling better about their income and about their home equity. As a result, remodelers are seeing increased revenue per project. Almost 56% said that their company’s average revenue per project has increased over the past twelve months. Only 6.7% said that the average project size got smaller. The largest set of respondents who had an increase indicated a boost of 6%-10% in project size (average revenue per project).

- When asked what percentage of their leads/inquiries turn into a new job, a large share of the responses clustered around 30% (27.4% said between 21% and 40%), and another cluster was seen around 70% (25.2% said between 61% and 80%).

- Contractors said that their ability to close leads is getting gradually better. The average response was 6.2 out of 10.0, because there was a large number who said that their conversion rate was staying steady. Those who are part of the 70% cluster would not be expected to look for improvement on an already very high conversion rate.

- When asked what government policies or regulations could impact their business, the one they pointed to the most (by far) was taxes. The following percentages of respondents said that these government policies/regulations will have an impact on their business: taxes (27.2%), EPA (8.0%), Immigration policy (6.3%), and health care policy (6.0%).

HomeAdvisor: Sink Installations Surge in 2016

HomeAdvisor: Sink Installations Surge in 2016  Nesting Is Investing

Nesting Is Investing  Urban Remodeling Trends in San Francisco, CA

Urban Remodeling Trends in San Francisco, CA  Prospective 2017 Home Improvement Trends: First-Timers and Fixer-Uppers

Prospective 2017 Home Improvement Trends: First-Timers and Fixer-Uppers  Impressive Resilience Seen in Single-Family Construction Data

Impressive Resilience Seen in Single-Family Construction Data

Are You Familiar With This Topic? Share Your Experience.